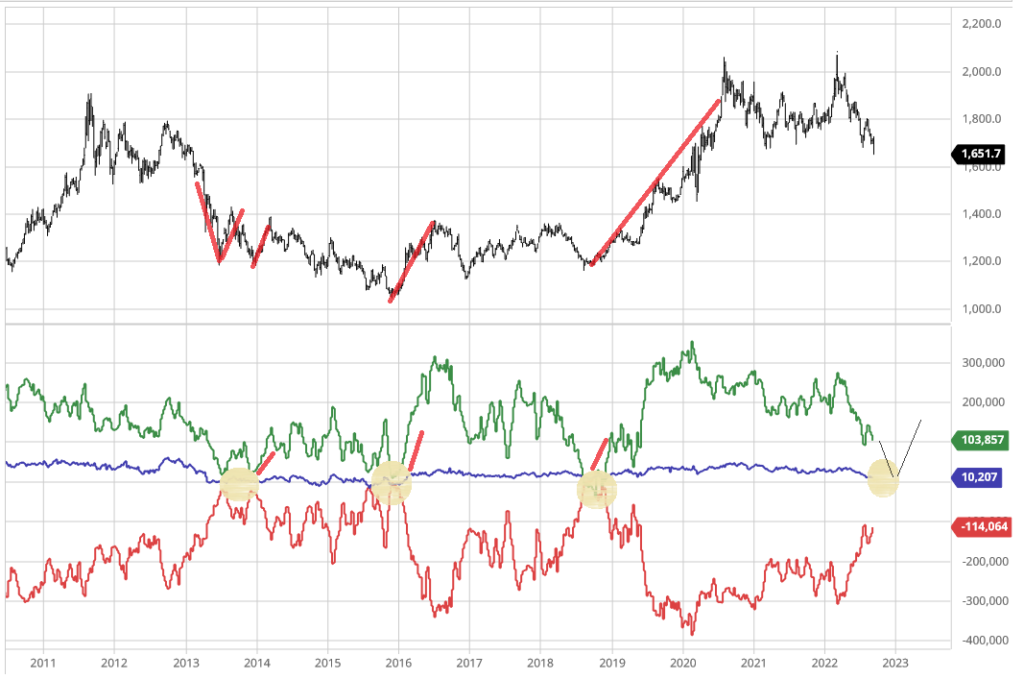

Gold and the COT data shows heavy shorts by large speculators, similar extreme numbers as back in 2013/2014, 2016 and 2018. Support soon?

Gold is breaking below 1700 this week, as US yields rise on hawkish FED expectations that will have to be very aggressive to bring down the inflation. We know that USD is on the rise and as long that’s the case, gold may not find the buyers that easily. However, I assume that COT data will now shows us even more heavy shorts by large speculators after recent breakdown, but data may show similar extreme numbers like back in 2013/2014, late 2016 and 2018.

So the question is can gold stabilize?

We will have to wait and see, but with Elliott waves approach we will try to determine if gold is about to turn, or will it continue lower. If you are interested, make sure to track wave counts with us.

Have a nice weekend.

Grega

Interested in commodities? Check our latest Invesco DBC commodity index chart. CLICK HERE