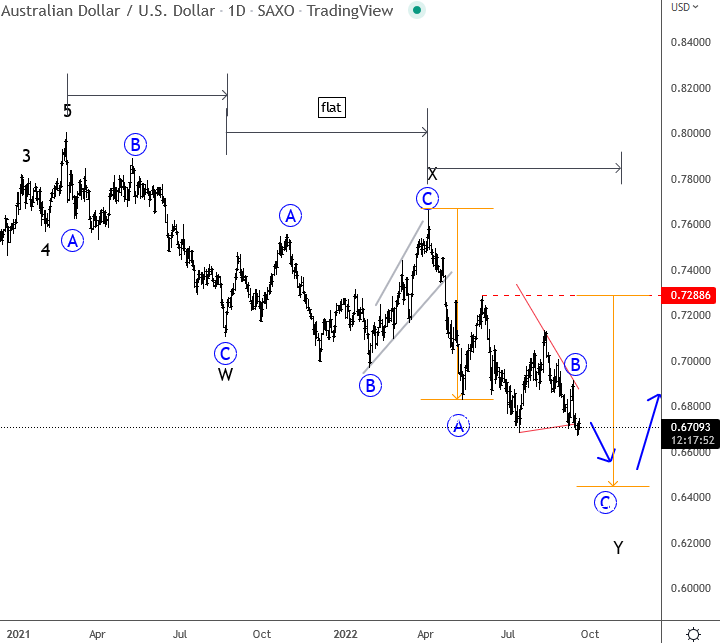

Aussie remains bearish after RBA policy meeting, but from Elliott wave perspective we see it finishing a complex corrective decline.

Markets were slow at the start of a new trading week because of the holiday in UK, but this will be expected to change as speculators wait on CB policy decisions. RBA meeting was the first event where members judged that a further increase in interest rates would help bring inflation back to target and create a more sustainable balance of demand and supply in the Australian economy. They discussed the arguments around raising interest rates by either 25 basis points or 50 basis points. They see rates coming back to normal, meaning that sooner or later speculators could see this as bearish for the Aussie.

From an Elliott wave perspective, we see pair in a deep complex correction, currently in B of Y, so there can be more weakness coming soon, especially if stocks will continue to weaken this week on the hawkish FOMC decision. So short-term pair can stay bearish but from a longer-term perspective, we assume that the pair can find a support near 0.64-0.65, possibly later this year.

Check also our latest weekly macro update. CLICK HERE