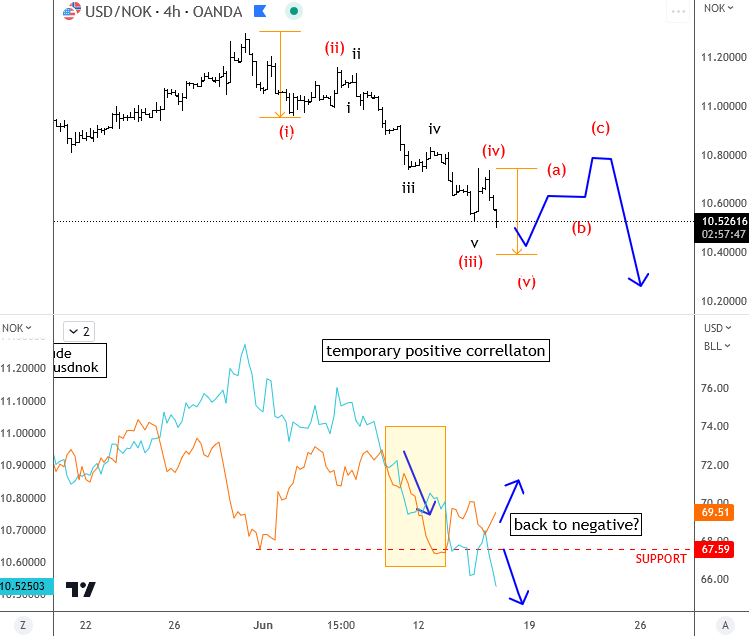

Crude oil is trying to stabilize after the FED rate decision yesterday, showing some interesting intraday support this week around $67.00 per barrel from where we may see a recovery if risk-on will resume by the end of the week. Also, the global oil supply fell 660k bpd in May on OPEC+ cuts, which can help to stabilize oil price going forward. With higher crude we like NOK. Keep in mind that crude oil and USDNOK, both traded south recently, but crude trying to stabilize now. So support on Crude can cause even more weakness on USDNOK if we consider that USDNOK is trading down already without help of crude oil prices. In fact, current bears on USDNOK are also acting impulsively so far with clear five waves down on 4h time frame while price is also breaking the daily trendline support.

That been said, we favour more weakness on USDNOK, and possibly even short idea after a-b-c rally.

Trade well, trade small, and dont forget on stop losses!

Grega

Sugar and Cocoa In the Bull Run CLICK HERE

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.