On a weekly basis, US jobs data came in better than estimates, continuing to undermine the central bank’s efforts to curb high inflation. More specifically, according to the announcement of the Ministry of Labor, the hirings amounted to 263,000 in November against the forecasts for only 200,000, therefore S&P 500 gained +1,13%, Dow Jones Industrial Average +0,13%, Nasdaq Composite +2,03%, and DAX40 in Europe lost -0,08%.

The Economic Calendar of the week (5/12 – 9/12) has very interesting readings, such as German Services PMI, Eurozone Services PMI, US Services PMI, and UK Services PMI for November, German Factory Orders for October, US Trade Balance for October, China Trade Balance for November, German Industrial Production for October, Eurozone Preliminary GDP for Q3, Japan GDP for Q3, US Core PPI for November, US API Crude Oil Stocks (weekly based), US Crude Oil Inventories weekly based, U.S Initial Jobless Claims (weekly released), including the speaking of Mrs. Lagarde and Mr. Powel and many of the officials.

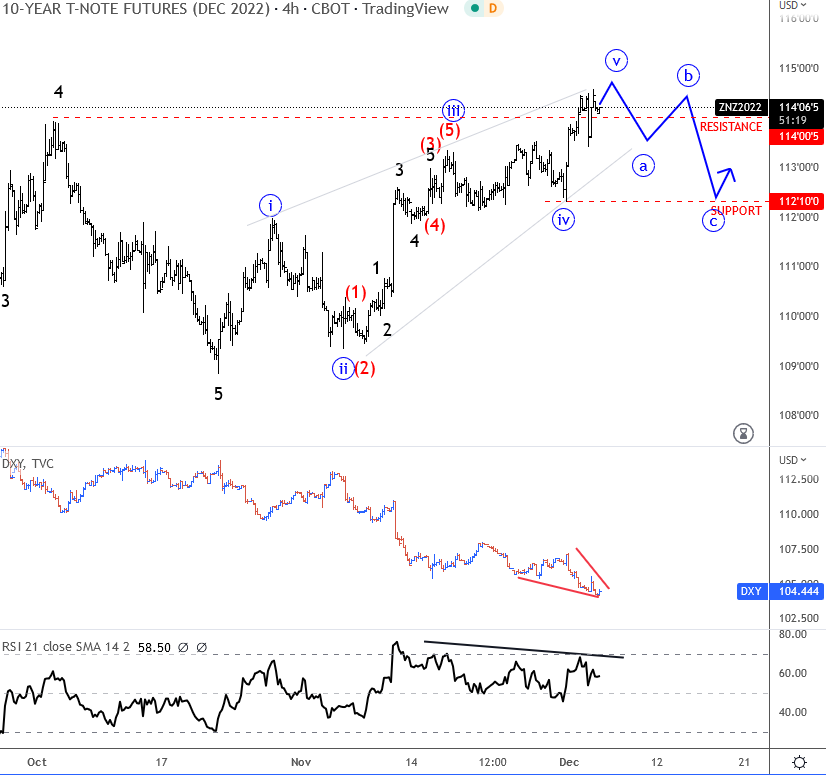

Tehnical look – The USD

Technically speaking, we see 10 year US notes coming higher, but seen in a fifth wave of a bullish reversal while DXY is falling back to the lows most likely hunting stops that were placed after NFP. But focus should be Powell words from last Wednesday, when he was not that hawkish anymore, so even good jobs data may not change his decisions.

by Grega Horvat

Interested in cryptoccurenices? Check how we follow the LTCUSD HERE