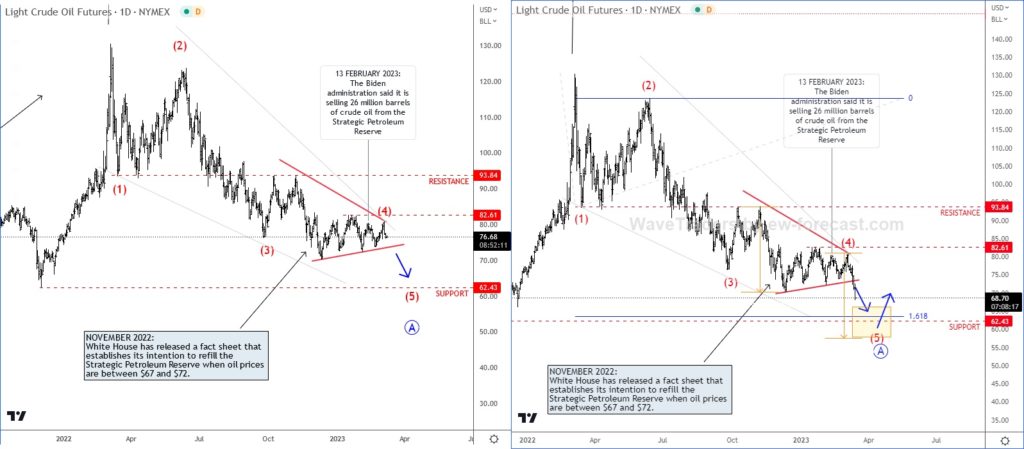

Crude oil is breaking lower out of bearish triangle pattern, which indicates for the final leg from Elliott Wave perspective.

Crude oil was trading sideways for the last couple of months, which we saw it as a consolidation range within downtrend. We have been talking about that in our previous update that can you check HERE.

As you can see, Crude oil is now finally breaking lower for wave (5) of a higher degree wave A, out of projected bearish triangle pattern within wave (4). In Elliott wave theory, 5th wave is the final leg before we will see a higher degree corrective recovery into a higher degree wave B.

However, there can be still room down to 65-60 triangle target area, where we also see ideal 138,2% – 161,8% Fibonacci target zone.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

JPY: The Safe-Haven Is Back. Check our blog HERE.