Risk-on sentiment can push SP500 higher and USD lower, as 5th wave is still missing from Elliott wave perspective.

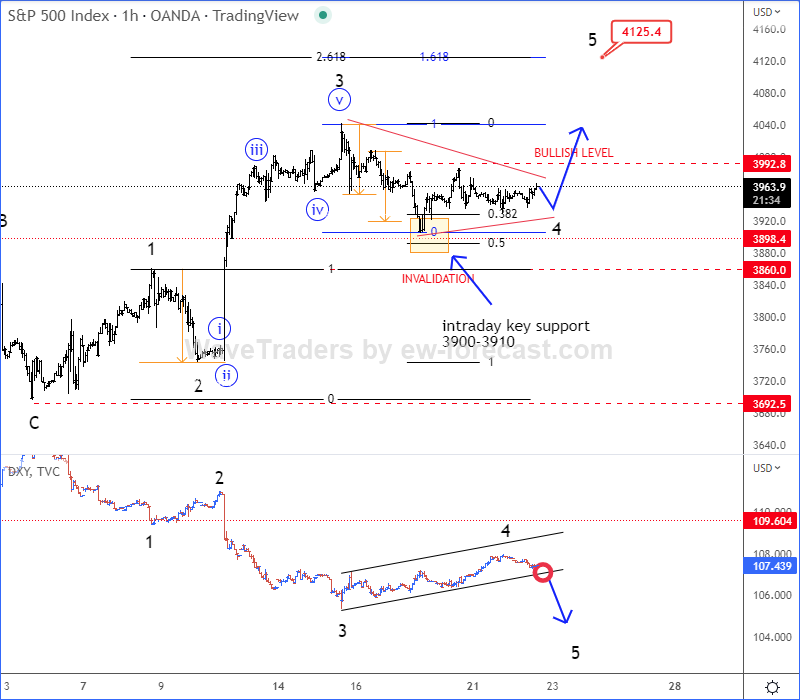

SP500 is trading in an intraday bullish impulse in current risk-on sentiment, but we can see it slowing down now within wave 4 correction, which looks to be a bullish triangle pattern. So, once a triangle is fully completed, be aware of a bullish resumption for wave 5 with room up to 4125 level. Invalidation level remains at 3860.

At the same time US Dollar Index – DXY can face even more intraday weakness in risk-on sentiment, as it’s in negative correlation with the SP500. So, after recent corrective recovery in wave 4, watch out for a bearish continuation within 5th wave towards 105-104 area. Invalidation level is at 109.60.

Trade well!

Check our latest article about Crude OIL. CLICK HERE