In the latest Fed’s rate decision, there were some important signals for a potential end of hikes:

• The staff predicted a mild recession in general, however, a forecast is for modest growth, not a recession.

• A decision on a pause was not made today.

• The economy is likely to face headwinds from credit conditions.

• Policy is having an impact on housing and investment.

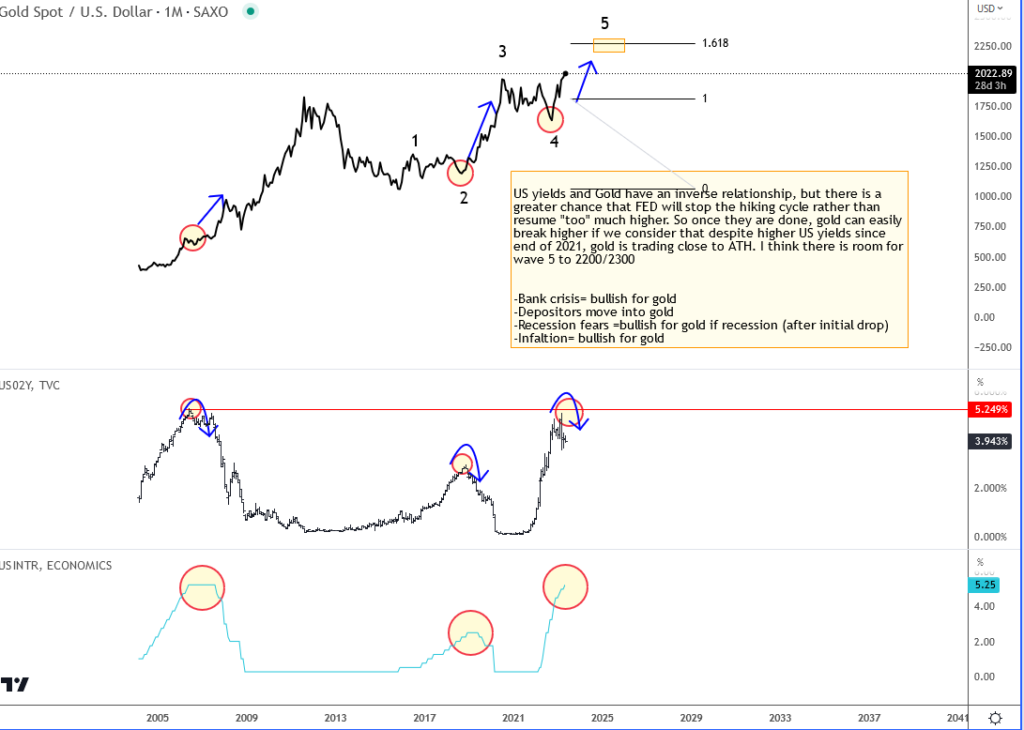

If FED is really done soon with rates then Gold can easily break higher if we consider that despite higher US yields since the end of 2021, Gold is trading close to ATH. So if US yields are going to stay sideways or move down at some point, maybe later this year, or 2024, then gold will rally.

I think there is room for wave 5 to $2200/$2300. Near-term support on dips is at $1970 and $1940.

However, regarding the rates decision going forward, it’s going to be important to track US inflation data. The CPI figures will be released today at 12:30GMT. Move below 5% y/y will likely send US dollar lower with yields which can be supportive for gold. But even if inflation would come out very high once again with a “negative” surprise for the FED, I think gold would bottom after initial spike down, since we know that gold is a hedge for inflation. Also, the bank crisis in 2023 is supportive for gold as some depositors moves in to physical gold.

For more short-term outlook on gold, make sure to check out our premium services.

Trade well,

Grega

I talked about this one in our webinar last week. Watch it here below.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Tesla Forms Bull Setup. Check our free chart HERE.