Platinum is looking for a bullish resumption, as it can be unfolding a new five-wave bullish impulse from Elliott wave perspective.

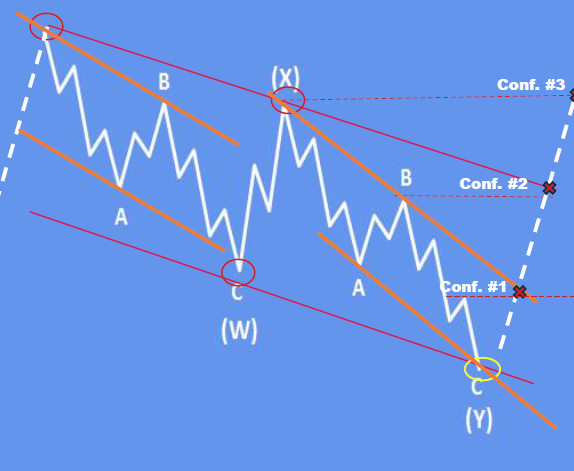

Platinum was trading in a correction for the past two years, which we saw it as a Double Zig-Zag or complex W-X-Y corrective pattern. At the end of 2022, we have seen strong bounce in an impulsive five-wave fashion, which was signal for a completed correction within uptrend.

Well, after a sharp pullback in wave 2 with nice bullish setup formation, Platinum is now trying to break higher into wave 3 of a five-wave bullish impulse, especially if it manages to stay above channel resistance line. So, if breaks above 1200 bullish confirmation level, we can easily expect a bullish resumption towards 1400 – 1600 area.

Double zigzag

•Corrective channels are important!

•Early confirmation of a completion is a break out of a corrective channel of wave Y, then break of wave B

•Final confirmation is above wave X

For more analysis like this you can watch a recording of our latest live webinar from April 17 2023 below:

Become a premium member

Get daily Elliott Wave updates for SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.