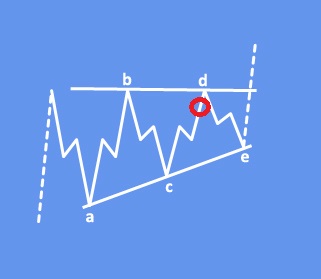

GBPJPY is in sideways consolidation, which we see it as a bullish running triangle pattern from Elliott wave perspective.

GBPJPY pair is still at the highs on a daily chart, which looks like a consolidation within uptrend, ideally as a bigger bullish running triangle pattern within higher degree wave (4).

Currently we are tracking final stages of a complex w-x-y rally into wave D that can cause another wave E slow down. So, once a triangle fully unfolds, be aware of a retest of the highs for wave (5) of a higher degree wave C/B.

The running triangle is a region of horizontal price movement, a consolidation of a prior move, and it is composed of “threes.” That means each of the A-B-C-D-E waves have three subwaves.

For detailed view and for more analysis like this you can watch a recording of our latest live webinar from April 11 2023 below:

Become a premium member

Get daily Elliott Wave updates for some major Digital currencies, FIAT currency markets, major stock indexes, gold, silver, crude etc. or apply for unlimited access to the Elliot Wave educational videos.