Dear traders and followers, I am excited to announce that my special article about the EURUSD has been published in New City Trader Magazine !

Check out the insights on how the recent market trends and macro factors could shape the future for the EURUSD when comparing it to the bond market. Read the full article here (Page 67) https://newcitytrader.com/nct-mag-en/ The magazine also contains plenty of other interesting content

Copy of that article is also below.

Thank you for your support.

GH

Over the past few years, the EUR has experienced a sharp decline against the USD, which has been a bearish trend that accelerated through the first part of 2021, with the EUR/USD rate falling below parity and even reaching 0.96 at some point. The reason for this strong drop last year was the FOMC’s hawkish policy, which is typically the first bank to make big shifts in policy. It’s no surprise that investors and speculators turned bullish on the USD as the Fed hiked rates quickly from 0 to 5%. While other central banks were lagging, they eventually started to act with a delay. However, the FED hinted that the hawkish policy could be approaching a pause, and that’s when many currencies, including the EUR, turned up significantly to 1.1 at the start of 2023.

However, the FED hinted that the hawkish policy could be approaching a pause, and that’s when many currencies, including the EUR, turned up significantly to 1.1 at the start of 2023.

We see this recovery as a reversal pattern, as it is a sharp and strong move, called an impulse in Elliott wave terms. Such price action typically indicates that the market is bottoming and that times are changing. From that perspective, it can be an interesting resumption of this new recovery after a correction – an A-B-C retracement. Comparing real-time data with the “basic structure,” we can see that most likely, the EUR/USD pair is currently in a corrective phase. Therefore, we believe that the recovery can resume after this pullback is completed.

Despite this bullish structure, we need to consider what’s happening in other markets and the fundamentals and macro views that could support the idea of a stronger EUR over the coming months or years.

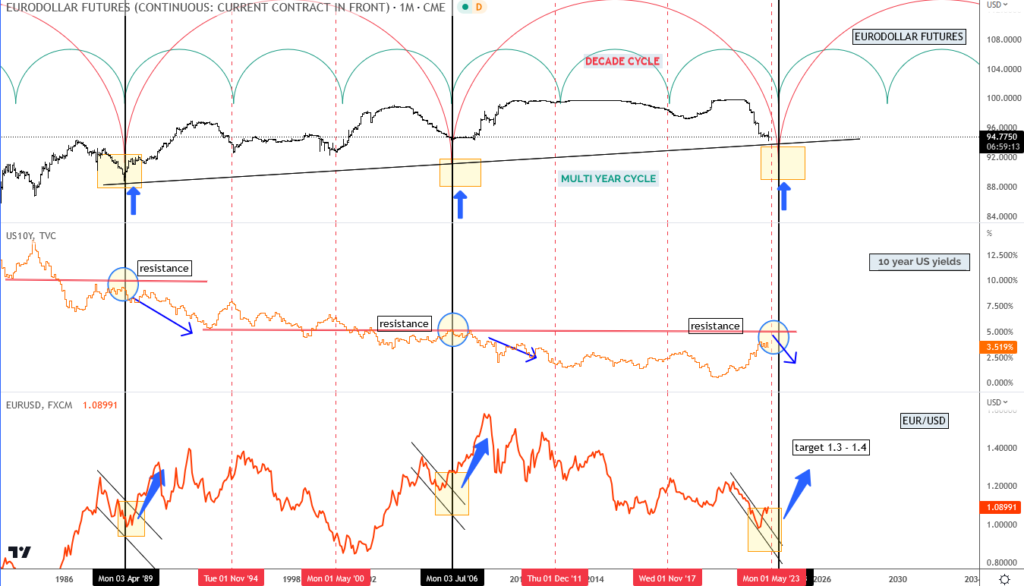

One of the most important drivers of the EUR/USD pair are interest rates, particularly the rate differential. EURODOLLAR futures are also significant since they represent US dollars deposited in foreign bank accounts.

This has always moved in cycles, and there is less interest in holding USD in foreign banks if the Fed is going to stop the hiking cycle. Notice that EURODOLLAR futures are approaching the end of a multi-year and decade cycle.

This could be a significant period for a new shift in trend, given that we believe the FED will really slow down the hiking cycle due to the recession risk after the recent bank crisis.

We see the 10-year US yield also trading at horizontal resistance, testing previous lows, which appears to be the same pattern compared to 1989 and 2006. Therefore, if the Fed ends its hikes or even cuts them by the end of 2023, lower 10-year US yields will have an impact on EURODOLLAR futures, and that’s when the EU-US rate differential can send the EUR/USD pair much higher, as it did after 1989 and 2006. Each time after that early bottom, the EUR/USD pair then recovered for around 30%.

With that said, we think there can be room for the EUR/USD to return to the 1.3-1.4 area after current pullback is finished.

Dear readers, traders and investors, I am happy and honored to be invited to contribute in this amazing magazine. I hope you enjoyed the read.

Grega

If you are active trader and interesting in cycle, sentiment and Elliott wave analysis make sure to check our services at www.WaveTraders.com

Become a premium member

Get daily Elliott Wave updates for SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.