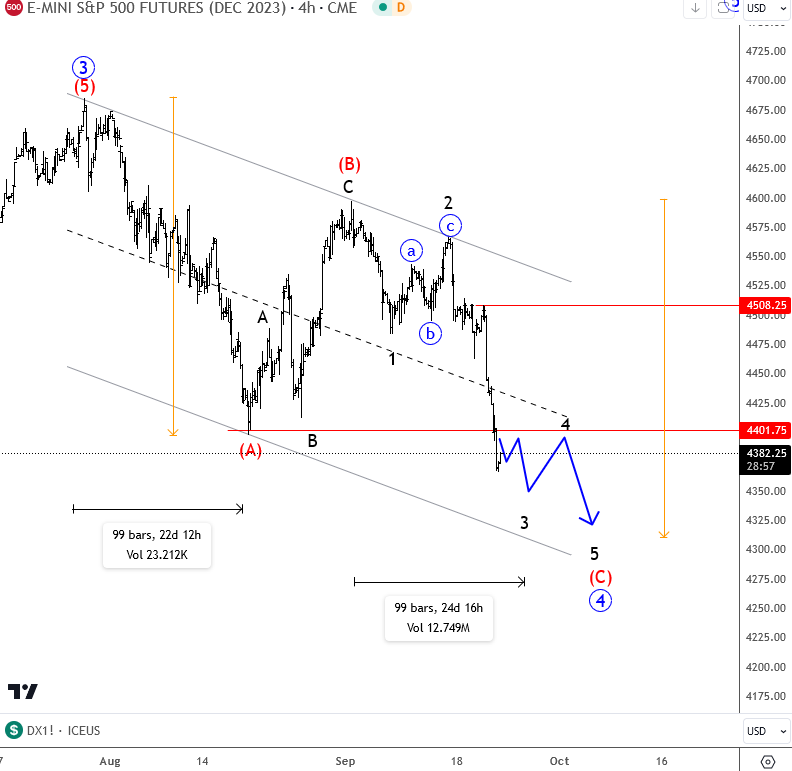

SP500 is coming lower within a zig-zag correction from technical point of view and from Elliott wave perspective.

SP500 is trading nicely as expected within a higher degree correction as we have been warning about in our past updates. On September 7th we shared tweet and article about that deeper higher degree correction, which is turning out to be a zig-zag (A)-(B)-(C) corrective pattern within wave 4.

Full article you can see HERE

As you can see today, the SP500 is now retesting the August lows for wave (C), but wave (C) is a motive wave and it should be completed by a five-wave cycle of the lower degree. So, more weakness can be seen, thus be aware of lower support levels down, near 4300 where SP500 can stabilize and possibly even turn back to bullish mode. But for this to happen we need minor intraday impulse up, back to around 4500 to make sure that bulls are back.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Emerging Markets Show A Corrective Decline. Check our free chart HERE.