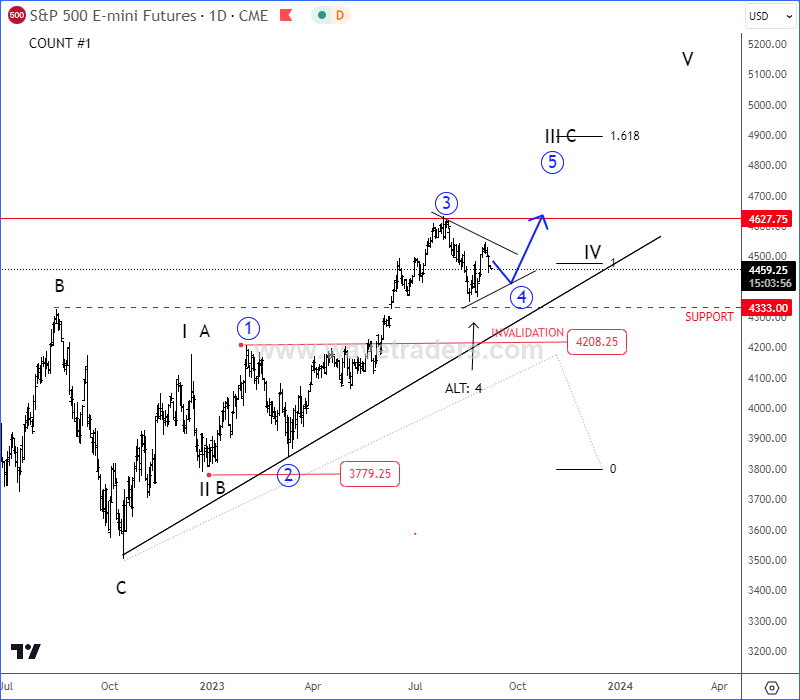

SP500 is in a higher degree correction, as we see it in a larger consolidation within uptrend by Elliott wave theory.

SP500 has been bullish most of the year; a trend that can resume after a corrective pullback, which is underway now, seen in wave 4 on a daily chart.

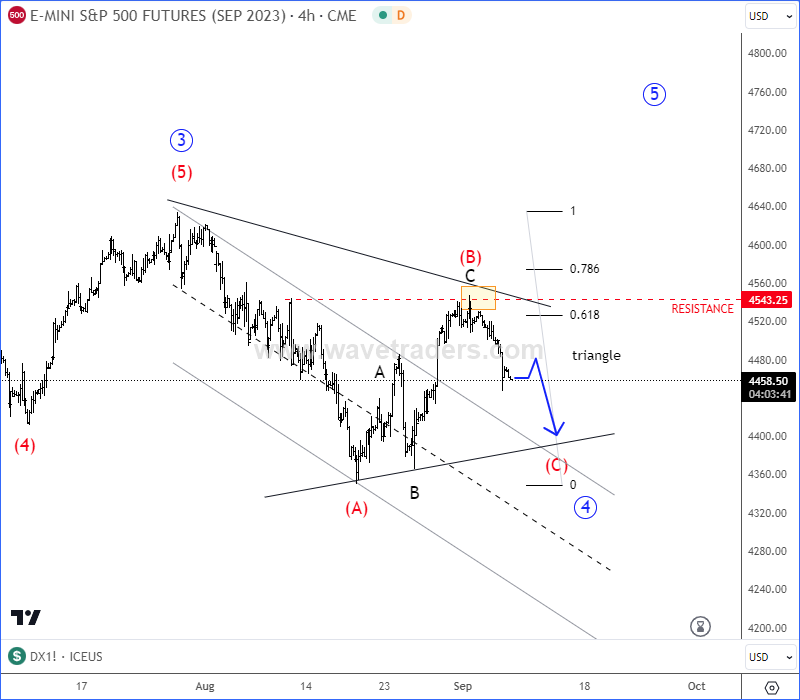

However, wave 4 should then be made by three waves before correction can come to an end; which is not the case yet, as the recent bounce to 4492-4543 resistance area looks like a corrective wave, ideally wave (B), so be aware of more weakness after recent turn down. Ideally, wave (C) of 4 is now underway towards the lower side of a summer range. If wave (A) low is not going to be broken then wave four can also become a triangle rather than deep A-B-C drop.

Become a premium member

Get daily Elliott Wave updates for SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Final Impulse Wave Pushes AUDUSD 0.63. Check our latest video analysis sponsored by Orbex HERE.