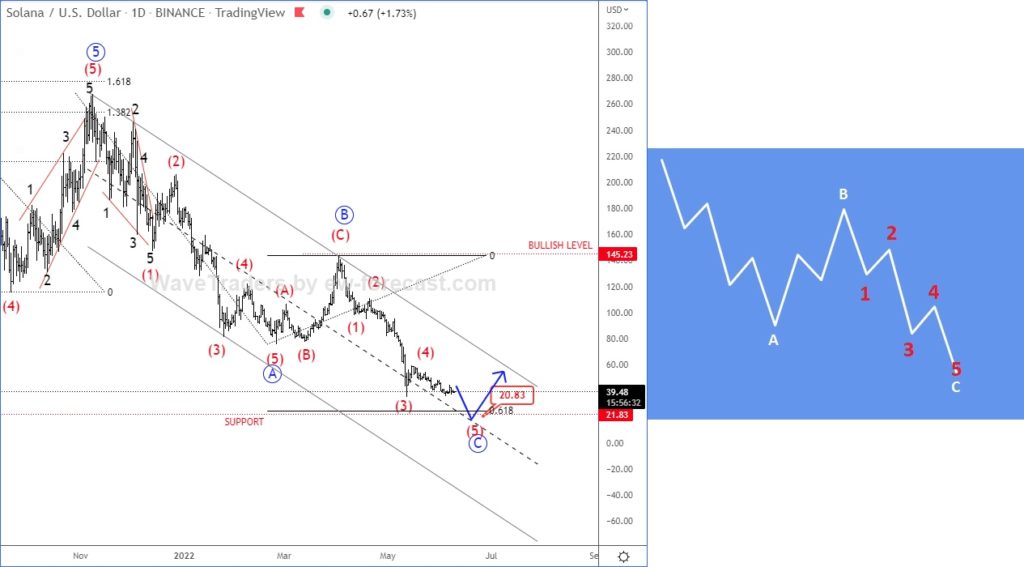

Hello Crypto traders, today we will talk about cryptocurrency Solana (SOLUSD). We see it finishing an interesting Elliott wave pattern, while it’s approaching strong and important support zone.

Well, what we see on Solana (SOLUSD) is a big A-B-C zig-zag correction from the all-time highs. Zigzag is a 5-3-5 structure, a corrective three-wave pattern labelled as ABC. Subdivision of wave A and C is in 5 waves, either impulse or diagonal, while wave B can be any corrective structure.

It can be actually already trading in final stages of wave C, as we see it finishing a five-wave cycle of the lower degree. Currently we are tracking final subwave (5) of C, which can ideally stop around strong 20 support area.

The main reason why 20 support level is so interesting is because of technical perspective. Back in 2021, Solana completed wave 4 correction right around that 20 level, which is now ideal support for a bullish resumption. As you can see, wave C and 20 level also comes exactly at 61,8% Fibonacci extension of wave A.

All that being said, we are patiently waiting for that final leg down and 20 support level, from where we will expect strong bounce, recovery and potentially a bullish reversal.

Trade well!

Check also our latest video about cryptocurrencies. CLICK HERE