NZDUSD Is Recovering In An Impulsive Fashion, as it’s one of the strongest currencies for the last couple of weeks.

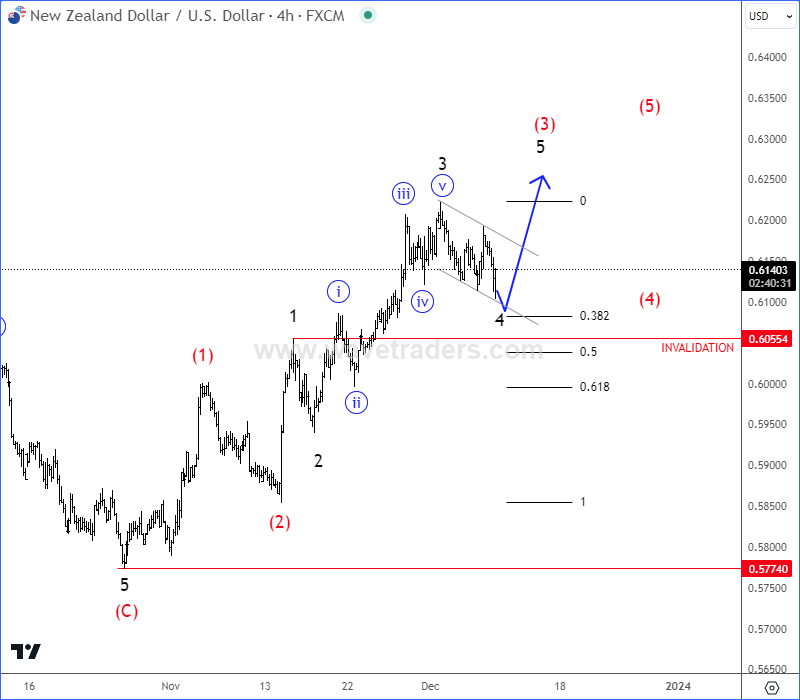

“The Kiwi” with ticker NZDUSD is finally trying to wake up with strong reversal, which can be signal that strong support at 0.5774 is in place, especially now that we have higher highs and higher swing lows formation on the 4h chart. In fact, there is also some accelerating price action through 0.6050 level which can be wave three of three as well, meaning there can be more upside coming, after wave 4 pullback.

The reason why we like the Kiwi (NZDUSD) for a potential longs is because New Zealand Dollar is one the strongest currency in the past few weeks and it may easily stay strong while we are in risk-on sentiment.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

DAX/SPX Ratio and EW Pattern Show Potential Resistance For DAX. Check our blog HERE.