DAX/SPX Ratio and EW Pattern Show Potential Resistance For DAX That Can Cause A Slow Down On German Stocks

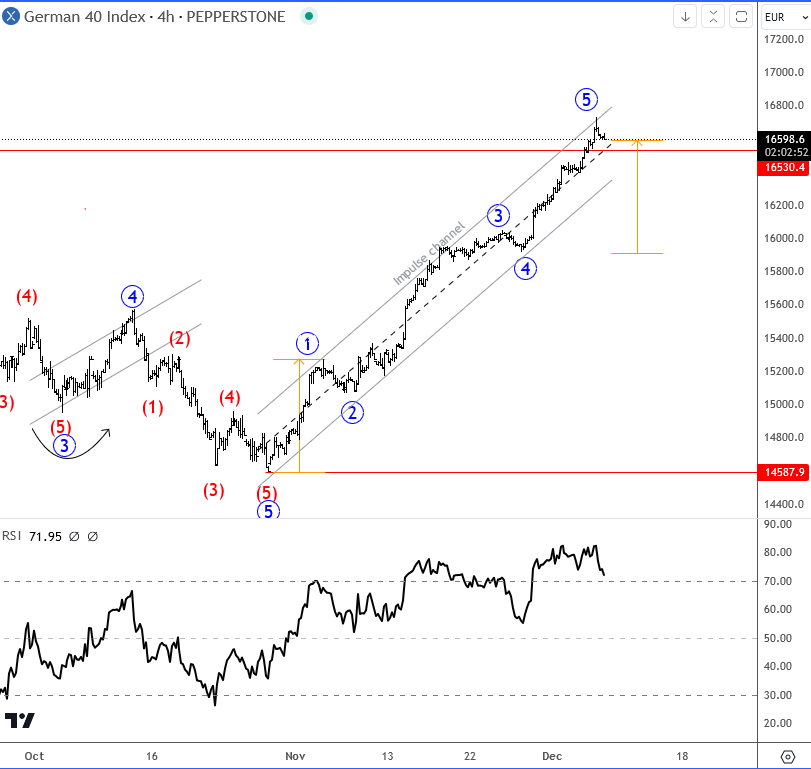

Just a week ago we shared a free chart of DAX, in which we are tracking wave 5 of an impulsive rally that is now already at all-time highs, a potential resistance that can cause a corrective slow down. CLICK HERE

So bullish trend is back, but keep in mind that we have five waves up on 4h time frame, so traders should be aware of a limited upside and potential A-B-C retracement in weeks ahead. Some wave 5=1 resistance is at 16600 now. Break below the trendline support of an impulse channel will put temporary top in place.

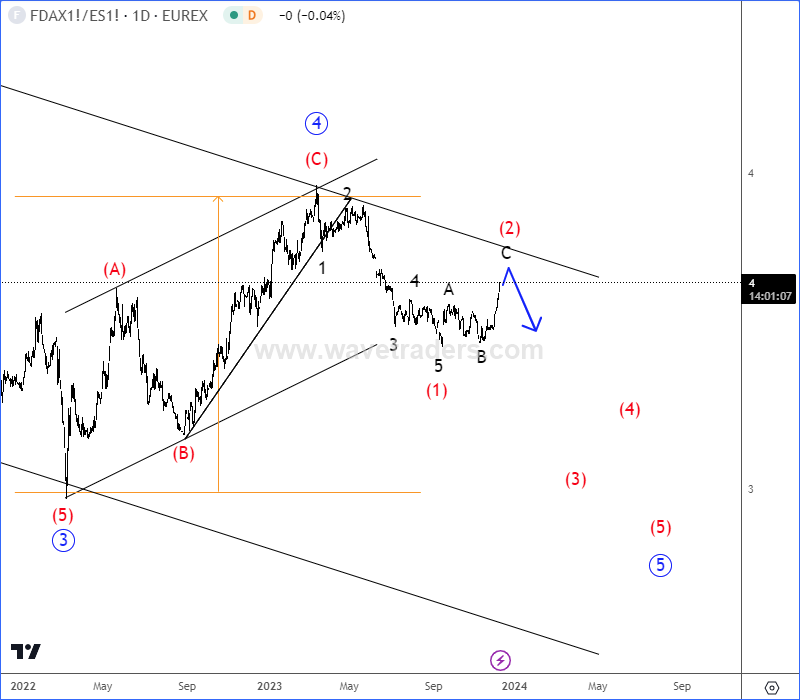

Another reason why DAX can slow down is also DAX/SPX (DAX against SP500) ratio chart, which is clearly bearish and it may easily resume lower within higher degree wave 5 soon, as we have pretty nice bearish setup formation. Ratio is telling us that SP500 can ourperform DAX in upcoming months.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Precious Metal Steps Into A Correction. Check our latest video analysis HERE.