Unfortunately, markets are where they are and we cannot force them to move in a particular direction. We see a neutral status at the end of the summer, but this volatility may come back in September. We may see some interesting price action already this week, when US will release their important jobs data. Fed watches this data closely, but what’s important is that they were very clear lately. They said that they will stay hawkish, even if FED’s actions will cause some harm to US economy. So for now, the USD remains in an uptrend and US yields chart is the main reason for the strong greenback. From an Elliott wave perspective we see US yields trying to break higher into a fifth wave now, so this can cause even more weakness XXX/USD pairs.

But, when fifth wave will hit a new high on yields, that’s when we should be aware of a new change in cycle, probably later this year.

So with FED actions, potential bad or good data, doesn’t really matter, the stock market has some hard times to recover. Yes, stocks can stabilize if we see bad data, but if we will start seeing bad data week after week then this means a big economic slow down and a potential recession.

Expensive capital, inflation, and economic downturn is a bearish case for stocks. There is simply no free cash available to be invested in the stock market.

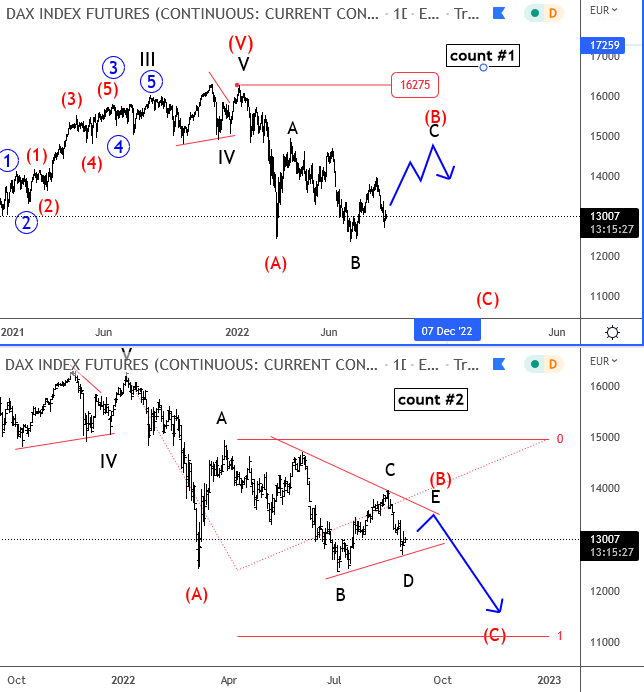

When it comes to technical picture of the stock market I will look at DAX, because neutral zone in this range suggests it’s wave B correction. The only question is if wave B will be flat or maybe a triangle. However, since even bearish triangle is not finished I think price can rally some in the near-term. But big resistance remains at 13800-14k, and 15k. Support is at 13k and then 11k, if 2022 lows are broken.

USE COUPON CODE TRIAL and test our services for 14 days. APPLY HERE

Trade well,

Grega

Check also our latest video analysis on some currency pairs. CLICK HERE