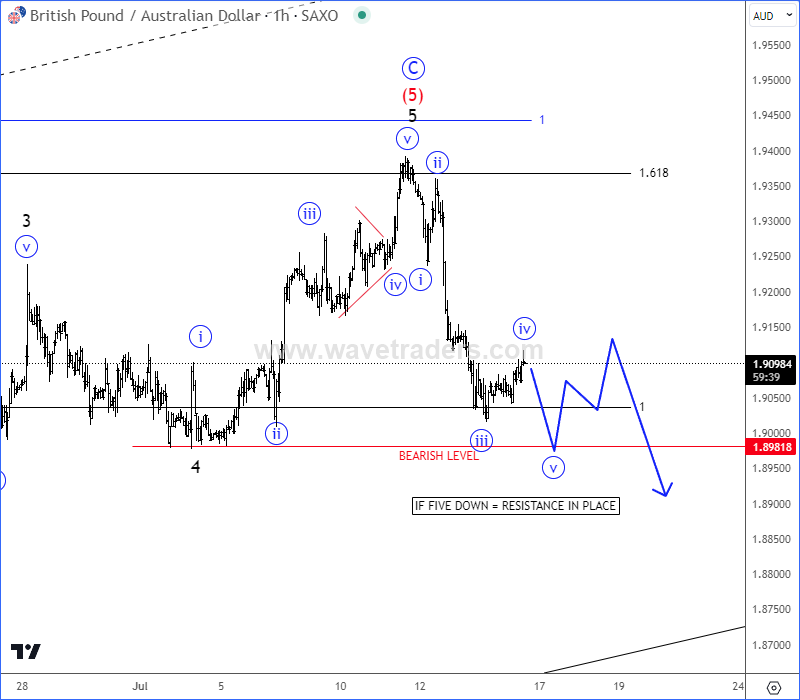

GBPAUD and GBPNZD pairs may have found the resistance, as we see sharp and impulsive reversal down from the highs by Elliott wave theory.

GBPAUD and GBPNZD currency pairs turned sharply down this week after a completed bullish cycle. With unfolding five waves down from the highs on the intraday basis, seems like resistance is in place and we should be aware of more weakness in upcoming days/weeks, we will just have to be aware of short-term corrective rallies.

GBPAUD looks to be unfolding an impulsive leg down from the highs, so be aware of more intraday weakness for wave »v« towards 1.8980 bearish confirmation level that can act as a temporary support for an intraday corrective rally before we will see more weakness.

GBPNZD pair is similar as GBPAUD, where we are tracking a five-wave reversal down from the highs after a completed final 5th wave of the wedge pattern within wave C. So, watch out for more intraday downside pressure for wave (5) towards 2.0450 area, from where we may see a corrective pullback before a continuation lower.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

New Surfing The Waves Elliott wave video is out sponsored by Orbex. Watch it HERE.