“USD is turning up vs EUR ahead the US debt-ceiling deadline. EURUSD pair breaking the trendline support“

The USD is higher while stocks are still somehow sideways. The reason for the higher USD can be optimism and speculation about US debt-ceiling. Speculators expect that they will approve it, otherwise, this will cause a lot of damage on the financial market. Yellen has repeatedly warned that »failure by Congress to raise the $31.4 trillion federal debt limit could spark a “constitutional crisis” and would unleash an economic and financial catastrophe for the U.S. and global economies”, as reported by Reuters.

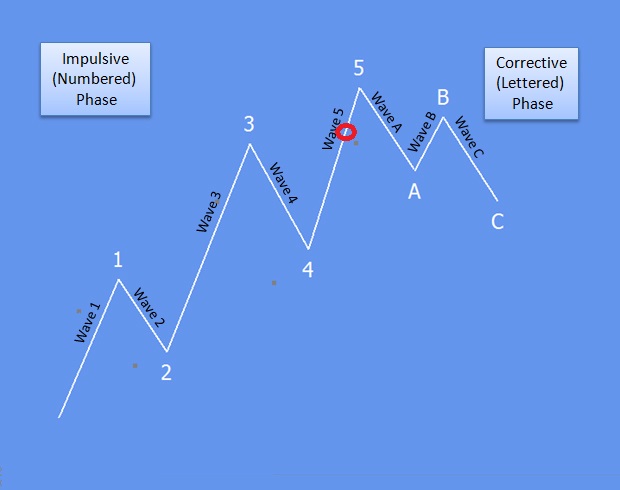

USD is trading higher with US yeilds, and it appears there can be more USD strength coming when looking at the EURUSD pair. The currency pair has been trading higher as expected and reached a new 2023 high, where we still think that the market experienced a “temporary” failure break to the upside, which certainly can be the case as recovery seems to be slow and overlapping up from March 1.0517 low. So, latest leg up EURUSD from that swing low can be an ending diagonal in wave 5 of a higher degree five-wave bullish structure, which is also a very strong long-term bullish pattern for the euro.

We now that nothing moves in straight line, there are always new swings happening, and it appears that new one is happening on the EURUSD pair as pair trying to break out of an important Elliott wave channel after a bearish divergence between highs of wave five and wave 3 which is usually the case at an important top of an impulse. That said, we think that a higher degree correction can be underway now, with next ideal support for the EURUSD this year visible at the former wave (4), 1.05 support area.

From Elliott wave perspective, every five-wave impulse from lows/highs suggests a change in the trend, but most importantly, after every five waves there comes a pause, a three-wave correction.

For a detailed view and for more analysis like this you can watch a recording of our latest live webinar from May 12 2023 below:

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.