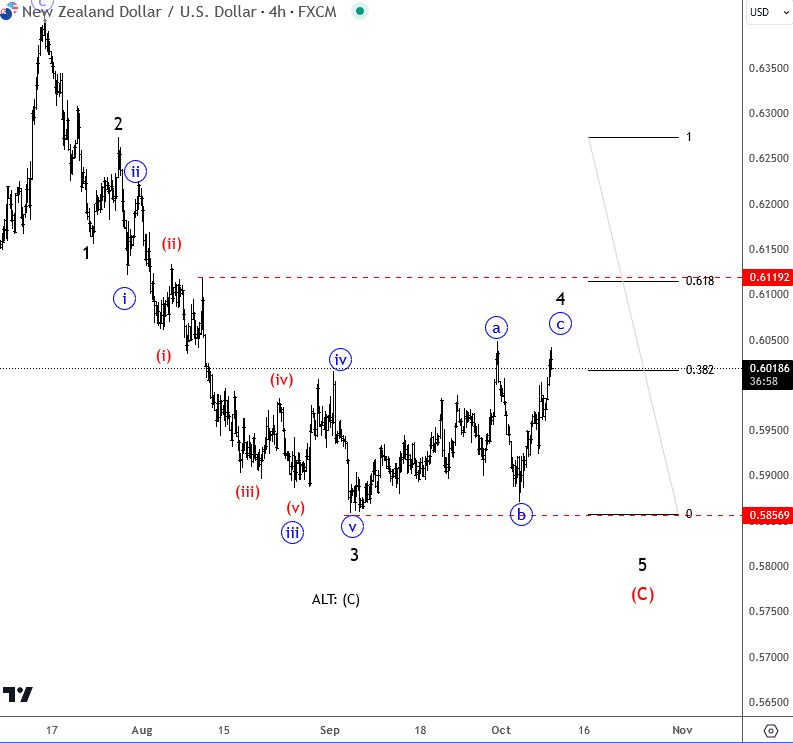

Elliott Waves On NZDUSD Suggests A Reversal From A New Low from technical point of view and by Elliott wave theory.

The Kiwi with ticker NZDUSD is trading south for the last few weeks but can be an impulsive wave C when looking a the daily chart, meaning that despite some strong leg down there can be a limited weakness and change in trend still this year.

In fact, wave (C) is a motive wave, so we need five subwaves down, which can be still in progress, as we expected in the past updates, where we mentioned and highlighted an a-b-c corrective rally in wave 4.

After recent a-b-c corrective rally in wave 4, we can now see it on the way back to lows for final wave 5 towards 0.58 – 0.57 area, where market may find the strong support. So once new lows are hit, be aware of the opposite, new change in trend, because we know, after every five waves dirrection change.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Elliott Waves Suggests USDMXN Can Be A Nice Short. Check our blog HERE.