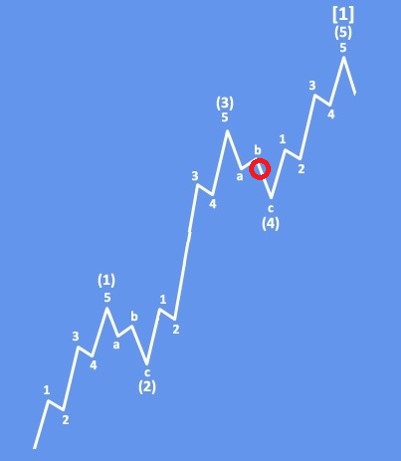

GBPJPY can be eyeing 190 area, as we see an unfinished five-wave bullish cycle from technical point of view and by Elliott Wave theory.

GBPJPY pair has recently moved to a new high, after coming higher out of wave (4) running a triangle pattern at the start of 2023, so it’s ideally trading in final wave (5) od C of B. However, there can be still room for another push higher as the current recovery from 158 is an incomplete impulse.

It’s ideally now slowing down within subwave 4 of (5) before a continuation higher for wave 5 of (5). The first support is at 180, and then the second at 176.50 for a flat.

Basic Elliott Wave impulse is strong and impulsive movement, which should be completed by five waves in different degrees.

Become a premium member

Get daily Elliott Wave updates for SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

What is next for the USD vs CAD and MXN?. Check our latest quick video analysis HERE.