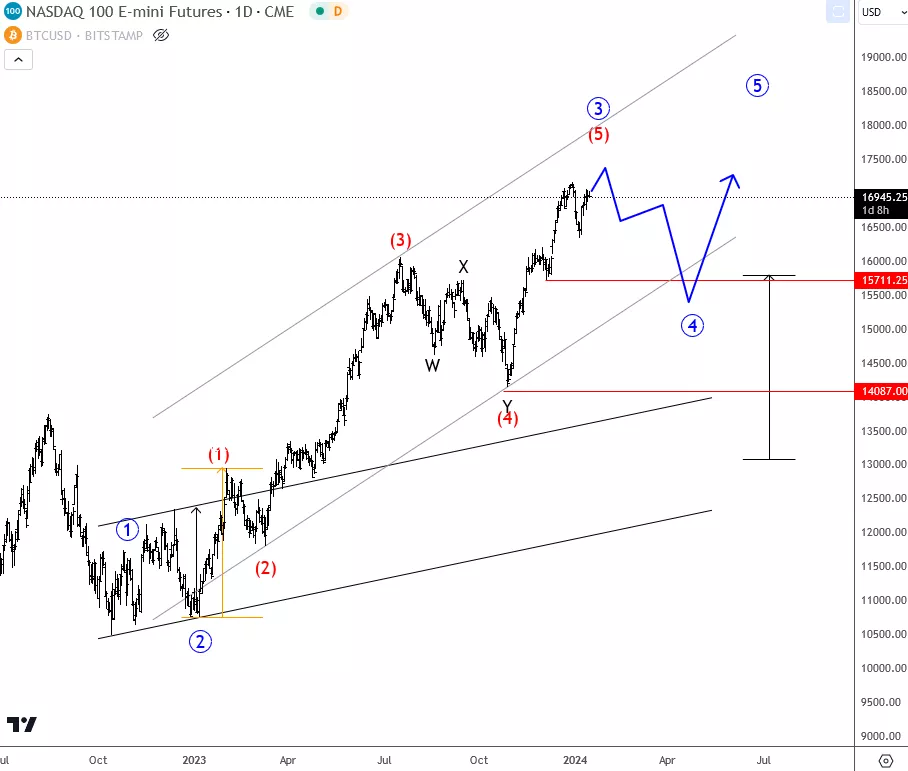

NASDAQ100 May Face A Higher Degree Correction from technical point of view and by Elliott wave theory.

The NASDAQ100 had a good run in 2023, thanks to the tech boom. Cryptos also bounced back strongly, closely following the market trend. Looking at the daily Nasdaq100 chart, we notice a clear upward trend with higher highs and swing lows. However, it’s important to remember that even in an uptrend, there can be retracements and corrective waves.

The chart shows that the recovery is not yet complete and is unfolding in five waves. Currently, we are in the fifth wave of three, approaching a resistance level. There might be a retracement, but ideally, it would be only wave four within the overall uptrend. A strong support level is around 16000, coinciding with the channel support. Another significant level is at 14000.

The future movements in the stock market will be influenced by the USD and the Federal Reserve’s policies on interest rates. Currently, expectations of lower rates and lower inflation are positive for stocks. However, if the Fed maintains higher rates for an extended period, stocks could consolidate for a longer time.

Alos it’s crucial to consider the possibility of a recession. If this one suddenly catches the Fed off guard this year, both interest rates and stocks may decline simultaneously. This scenario should not be ignored either.

For a detailed view and more analysis like this you may want to watch below our latest recording of a live webinar streamed on January 15th:

Become a premium member

Get daily Elliott Wave updates for SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

ETF Approved With Bitcoin At Resistance. Check our free video analysis HERE.