Dear traders,

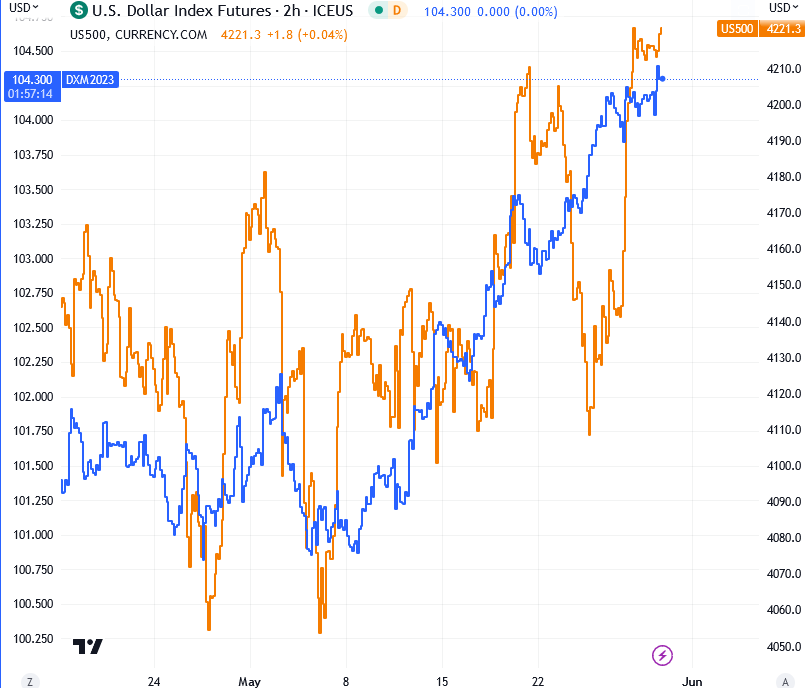

We bring you an update on the NZDUSD market, following our previous article (HERE) discussing bearish implications. Recent developments have seen stocks rebounding, and the USD maintaining its uptrend after an agreement between US President Biden and Speaker Kevin McCarthy to raise the debt limit for two years. The current question is which of these two forces will give up first: the USD or stocks? The answer may lie in this week’s economic data.

Today, the focus is on the US Consumer Confidence report, followed by the PMI data on Thursday, and the highly anticipated US Non-Farm Payrolls (NFP) report on Friday. These upcoming releases will play a crucial role in shaping the market’s direction.

From a technical standpoint, the USD has been experiencing a strong recovery. However, the presence of five upward waves since early May indicates that the current bullish trend may encounter resistance in the 104.50-105.00 range. Traders should be mindful of a potential new A-B-C correction pattern. Support levels on downward movements are expected at 103.70, followed by 103.

Once this correction concludes, we anticipate further downside movement in commodity currencies such as NZDUSD and AUDUSD. For NZDUSD, a notable resistance level to watch is the former low.

Stay informed and keep a close eye on the market as we navigate these critical developments. Remember to adjust your trading strategies accordingly and manage your risk effectively.

Grega

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Bonds Across The Globe Are Approaching Support. Check our blog HERE.