The USD Index is currently experiencing a recovery mode, driven by the upward movement of US yields and speculation that major central banks may implement additional interest rate hikes to combat inflation. Another contributing factor is the anticipation that the US debt ceiling negotiations will yield a successful outcome. Failure in these negotiations could result in a government shutdown, which could have catastrophic consequences for financial markets. Considering the ongoing bank crisis in the US, it is likely that every necessary measure will be taken to prevent any further issues.

Nevertheless, it is important to note that this current recovery or sideways price action on the USD Index is likely to be temporary, representing a consolidation within a larger downtrend. However, given the significant rebound observed, there may still be room for further gains in the coming weeks, potentially even reaching the 105/107 area to complete an A-B-C flat correction in wave II/B. Another valid interpretation suggests an A-B-C upward movement following five waves down, yet even this count implies limited upside potential for this year, around the 105-107 area. In either case, it is believed that the USD reached a major peak in 2022, making this recovery only temporary.

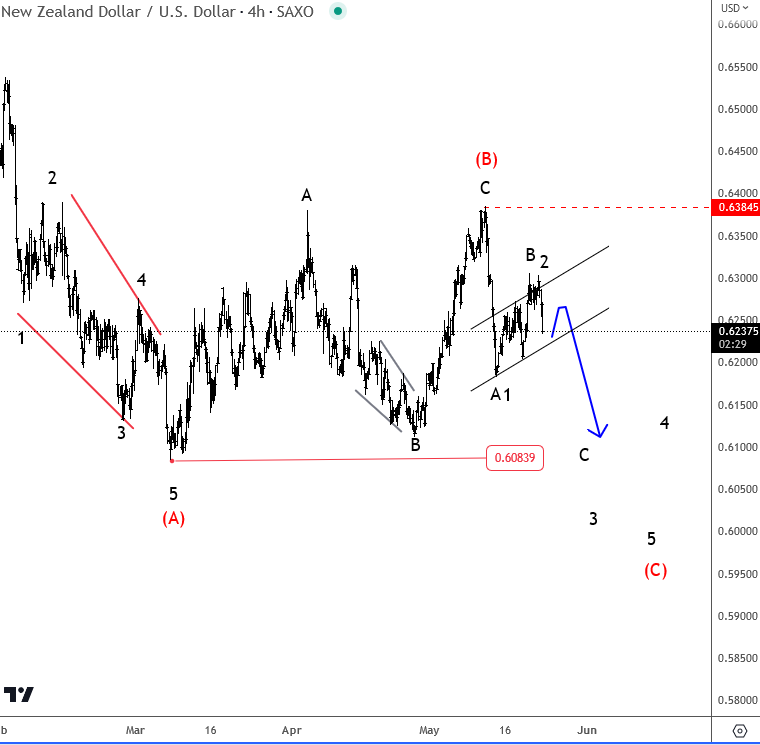

Nevertheless, in the short-term, there is potential for additional strength in the USD, allowing opportunities for profit. Interestingly, a bearish formation is observed in the Kiwi (NZDUSD), which could lead to volatility in the next 24 hours as the market awaits the Reserve Bank of New Zealand (RBNZ) rate decision. It is worth noting that the NZD experienced a decline during the last RBNZ event, even after a surprising interest rate increase. Considering this, it is less likely that the RBNZ will deliver another surprise this time. In fact, it is believed that they are nearing the end of their rate cycle, which could have a bearish impact on the NZD. From an Elliott wave perspective, it is expected that prices will trend lower as long as the market trades below 0.6384. However, buyers are anticipated to enter the market later this year, possibly around the 0.6 level.

Trade well,

Grega

Become a premium member

Get daily Elliott Wave updates for SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

If you are interested in a detailed view or more analysis like this, then you may watch a recording of our latest live webinar from May 22 2023 below.