Crude oil may stay in recovery mode, as we see it trading in a higher degree correction by Elliott wave theory.

Crude oil is bullish when looking on monthly and daily charts, but we can see it now in a higher degree corrective slowdown.

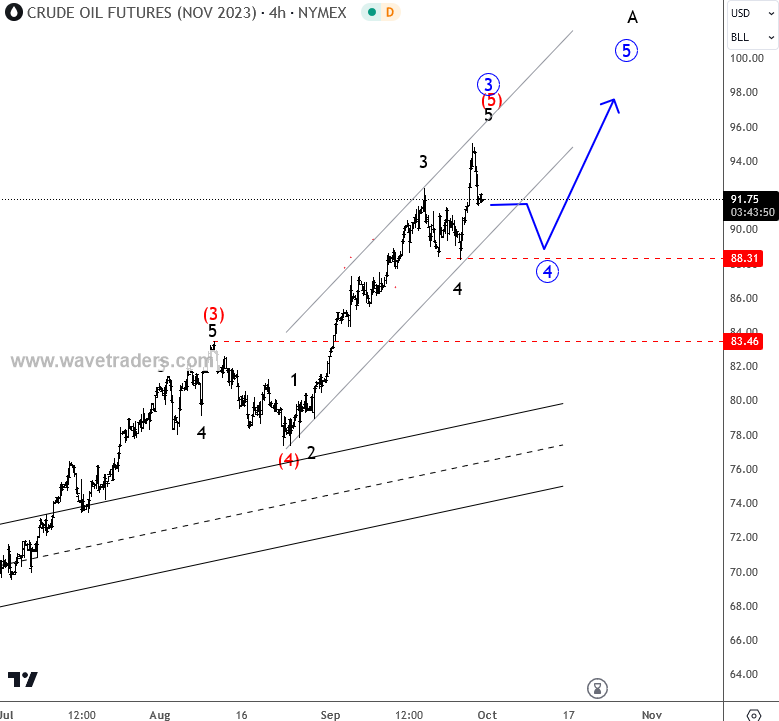

On a daily chart, we see a drop on crude oil from 130 area as a five-wave impulse into wave A that bottomed at 62 – 57 support area. It was a strong drop and spike back in May, when energy bottomed, so we are tracking a higher degree correction from there; wave (B), which can be much higher than firstly thought. The reason is strong bullish trend from the last few weeks, which is looking impulsive, currently still with five waves in the making for wave A, so be aware of more gains after set-back.

Looking a the 4h time frame, there can be some deeper pullback after recent sell-off from 94-95 resistance area, so ideally wave (5) of extended wave 3 is coming to an end. Support on dips for next wave four is at 88.30, deeper level is 83.46.

We talked about the support and recovery on commodities already back on June 8. CLICK HERE

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

SP500 Is At First Major Support. Check our blog HERE.