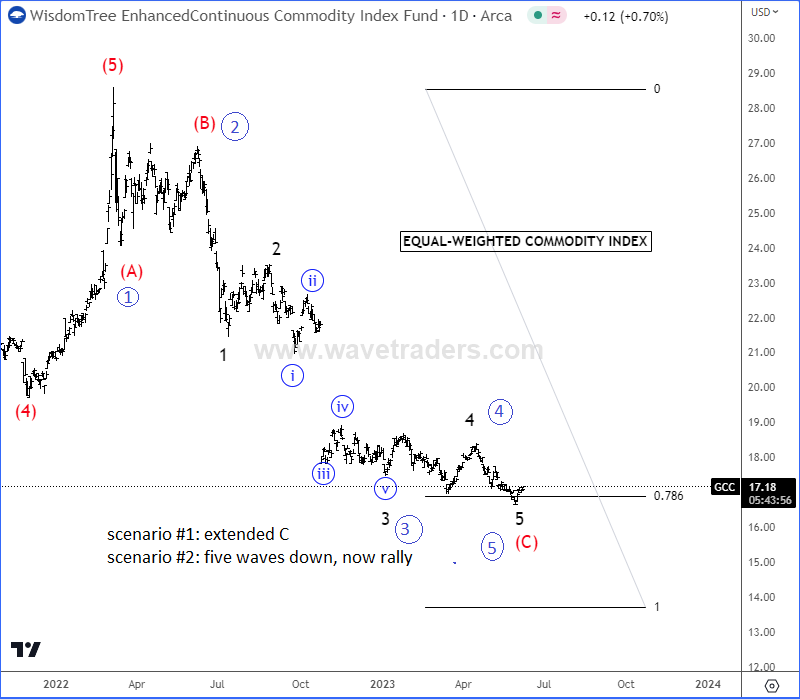

Commodities are at strong support zone, as we see them at the end of a higehr degree decline, down from 2022 highs

Commodities have been trading bearish for the last year, but we can see them in late stages of a higher degree bearish trend with price now approaching a strong support zone.

Commodities are actually already trying to wake up from the strong support after a potential A-B-C corrective decline from the high, or after an impulse (scenario #2). The important is that in either case, the Equal-weighted commodity index with ticker GCC is bouncing from 78,6% Fibonacci support, while the Bloomberg commodity index with ticker AW is the former wave (4) support with a potential wedge pattern.

Based on different interpretations, we assume that price can stabilize in the second half of 2023, and possibly even recover for at least a temporary period of time. At the same time, the USD can come lower, which is alos expected from an Elliott wave perspective as discussed in our webinar here.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.