“Time, space, and causality are only metaphors of knowledge, with which we explain things to ourselves.”

Fredrich Nietzsche

Editor’s Note: We swerve into the intellectuals weeds a bit in this issue. The point we are trying to make is this: basing trading ideas on cause and effect can be a very difficult proposition. Be sure to see our $/CAD wave analysis on pages 5-7 as an example of a trade idea based on price action. Our subscribers who traded this idea were paid off handsomely.

We share the currency equation below. It is seemingly simple equation. But in markets, we’re not quite sure if anything is really simple. When it gets simple, or appear simple, it’s likely time to begin to worry about your direction.

The currency equation of expected total return:

↑Expected Total Return = ↑Interest Yield + ↓Inflation + ↑Future Exchange Rate

This equation says the primary rationale for holding a particular currency is to maximize total return (thinking longer term portfolio flow time frames here), and expected total return is a function of the real yield achieved (nominal interest rates minus the inflation rate) and the future exchange rate (that which we are trying to forecast).

Do rising real yields cause the exchange rate to rise … or is it a rising exchange rate, impacting the fundamentals, which leads to rising yields?

In the real-world prices are driven by a tangled web of rationales which manifest into a complex array of feedback loops. We think this explains why it is so painfully difficult to determine which variables lead and which follow in a supposed correlation be it currencies or any other asset class. The word “supposed” is used because correlation is not causality; and worst still, causality itself is suspect as philosopher Sir Karl Popper explains (below).

We could give you plenty of examples of when a currency’s relative yield dropped, yet the currency soared, and vice versa. It is rarely an A+B=C causation (though we plead guilty at times pretending it may be that simple). In fact, if you were to stop and calculate the odds of forecasting correctly based on your inherent A+B=C causality mindset, you might start to question the efficacy of ever forecasting again.

In chess, there are 400 different possible positions after the opening two moves. There are 72,084 move combinations after each player has made two moves and over 288 billion scenarios after four moves each. The Shannon Number, which represents a conservative lower bound of the game-tree complexity of chess (the total possible move variations), is thought to be between 10^111 and 10^123. By comparison, there are 10^81 atoms that make up the known universe. I think we can all agree that national and global markets and economies are far more complex than chess. So tell me again why you think you can predict what will happen next in the markets or in the economy….

Bob Seawright, The Prediction Game

Maybe we should stop looking for causality as a source of confidence for our forecasts; especially if our causality flows from deductive reasoning. This is a key reason why Elliott Wave is our primary tool for analyzing trading ideas, as explained here.

Why we cling to Beliefs

Karl Popper, a German philosopher, referred to the black swan in his 1953 essay on The Problem with Induction. Induction application in the financial world is best known as “back testing.” Reading Popper gives one a deeper understanding of why we cling to beliefs so tightly and assume we can confidently project our expectations into the future and be confident we will be right.

Popper was fond of the philosopher David Hume and used his reasoning for much of the basis of his argument about induction, carrying it further. Popper wrote [our emphasis]:

But Hume held, at the same time, that although induction was rationally invalid, it was a psychological fact, and that we all rely on it. [We do rely upon it in our everyday life and it serves us well in lots of areas. But because “every moment in the market is unique” it serves us less well there.]

Thus, Hume’s two problems of induction were:

- The logical problem: Are we rationally justified in reasoning from repeated instances of which we have had experience to instances of which we have had no experience?

Hume’s unrelenting answer was: No, we are not justified, however great the number of repetitions may be. [The point here is each moment in the market is unique; it’s may rhyme with the past, but there are differences.]

And Hume added, it did not make the slightest difference if, in this problem, we ask for the justification not of certain belief, but of probable belief. Instances of which we have had experience do not allow us to reason or argue the probability of instances of which we have had no experience, any more than to the certainty of such instances.

2) The following psychological question: How is it that nevertheless all reasonable people expect and believe that instances of which they have had no experience will conform to those of which they have had experience? Or in other words, why do we all have expectations, and why do we hold on to them with such great confidence, or such strong belief?

Hume’s answer to this psychological problem of induction was: Because of custom or habit; or in other words, because of the irrational but irresistible power or the law of association. We are conditioned by repetition; a conditioning mechanism without which, Hume says, we could hardly survive.

Okay! We realize this is getting thick, hang in there, almost there.

Popper agreed with the first part of what Hume talked about; the logical problem. But Popper, couldn’t accept the irrationality of the second part—the psychological problem.

It is here where we get to the black swan. Popper posed that yes, we must use experience of past instances to advance our knowledge but we must accept the fact that just because so many past instances were effectively consistent, or the same, it does not therefore mean a theory based upon those past instances has been proven. The reason he says this is because there may be some future instance out there which invalidates all that has come before it, and it only takes one such instance to do that. Therefore, all theories can be falsified, but they cannot be proven simply by past experience.

…Or in other words, from a purely logical point of view, the acceptance of one counter instance to the view that, “All swans are white,” implies the falsity of the law “All swans are white”—that law, that is, whose counter instance we accepted. Induction is logically invalid; but refutation or falsification is a logically valid way of arguing from a single counter instance to—or, rather, against—the corresponding law.

This logical situation is completely independent of any question of whether we would, in practice, accept a single counter instance for example, a solitary black swan in refutation of a so far highly successful law. I do not suggest that we would necessarily be so easily satisfied. We might well suspect that the black specimen before us was not a swan. And in practice, anyway, we would be most reluctant to accept an isolated counter instance. But this is a different question. Logic forces us to reject even the most successful law the moment we accept one single counter instance. [Thus, can there ever be a market “theory”?]

The theory, or law, that all swans were white was falsified once a black swan living in Australia was discovered. Till then, everyone knew all swans were white. Done deal!

Of course, everyone knew Triple AAA-rated tranches of securities were safe—they had been in the past. The Credit Crunch nullified that view. Everyone knows that gold is the only real money and cryptocurrency is pure hype. This is still and open question or course, but Bitcoin’s performance is creating believers. Everyone knows inflation is a monetary phenomenon. But as we discussed in our Macro Issue yesterday (Inflation: From Transitory to the Weimer Republic), we questioned whether excess money is really the cause of inflation.

Everyone knows the dollar must go down over time. This would be our bet, and our longer-term Wave analysis points that way, but we shall see.

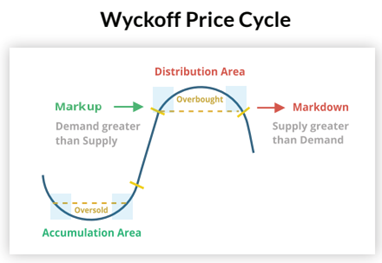

We could go on and on into infinitum with what everyone thinks they know. But again, it is why we base our analysis about what the market is telling us with its price action, not what others are saying about the market, to paraphrase market legend Richard Wyckoff.

Below is the Wyckoff Price Cycle. This the logic of this repeating cycle, which is fractal, is embedded in the Wave Principle.

But interestingly, the things we seem to think we know often don’t even have the consistent instances of induction in their favor. We cling to ideas in the financial world that have been falsified before, but seem to gather a second life. This isn’t even close to the word logical. But customs, habits, and beliefs are powerful motivators.

We hope you will consider the Elliott Wave principle as a tool for analyzing what the market is doing, instead of trying to link causality before making a trading decision. Markets are driven by real people, moving money for all types of different reasons, and often those reasons are completely irrational. The causality game can be very hard on our P&L.

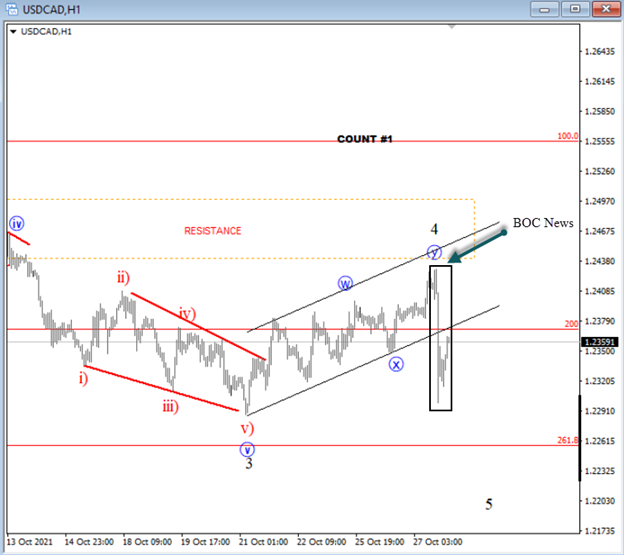

A look at your recent $/CAD analysis. On Tuesday, October 26, we posted this for subscribers, and in fact posted it also to our social media sites. Here is what we said:

Wave analysis allowed us to assign a high probability that choppy move higher, from the low labeled 3, was only a corrective wave; setting up for a profitable move down once the corrective Wave 4 was complete.

We suspected there would be resistance at 1.2452. Well, the pair rallied to a high of 1.2430 on Wednesday just before the release of the Bank of Canada interest rate decision at 10:00 a.m. ET. Here is what the Canadian dollar did after the news (which we didn’t try to predict):

Of course, in hindsight, we found the cause of this big move in the Canadian dollar (surprise moves markets). This from John Authers Points of Return Column at Bloomberg [our emphasis]:

The Bank of Canada surprised investors with a sharply hawkish statement of its intent to tighten monetary policy. It did this on two levels. First, it announced an outright end to its quantitative easing asset purchases, when it had been expected to keep tapering them gradually. Second it brought forward the timing of its first rate rise, which will now be in the “middle quarters” of next year, and not the second half. The central bank also lifted its forecast for inflation next year to 3.4% from 2.4% — a clear admission that this cannot be dismissed as “transitory.”

This is just one example of the type of insightful money-making analysis we share with our subscribers every day.

You can learn more about us, and subscribe to our service at our website. We also have live customer chat support to serve you.

Regards,

Gregor and Team…

Read more Macro analysis and our views about inflation. CLICK HERE