The whole problem with the world is that fools and fanatics are always so certain of themselves, and wiser people so full of doubts.

Bertrand Russell

There is a lot of shouting and screaming going on, as it relates to the future path of “inflation.” The volume and gyrations about higher prices are reaching fever pitch. Often in markets, over exuberance is a sign of a top. Is the inflation scare overdone? Let’s take a look.

There’s a broad range of inflation expectations in the market. On one end of the spectrum are those who believe the spurt in prices is primarily the effect of a global supply shock; this is Federal Reserve Chairman Powell’s view. His buzzword is “transitory;” i.e., once global supply chains normalize, all will be hunky dory again. Thing is, it seems the illustrious Open Market Committee is losing a degree of confidence in that view.

On the other end of the spectrum is what we would label the “Weimar Germany crowd.” This group says inflation is so completely embedded in the global economy thanks to all the government and central bank money pumping, we will see massive runaway inflation and devaluation of fiat currencies—buy Bitcoin now. Obviously, there are many thoughtful views which range with in the two extremes. We are closer to the “transitory” camp then the “Weimar Republic” crowd.

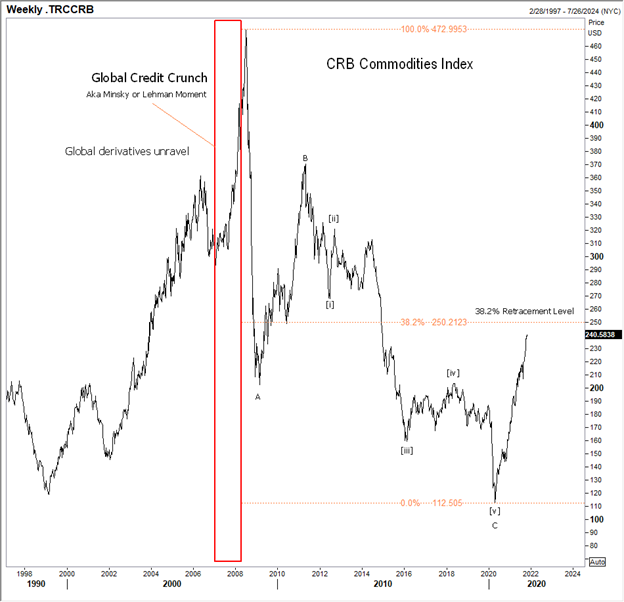

No doubt, commodities prices are rising. But, viewed from a longer-term perspective, as measured by the Thomson Reuters CRB Index, we haven’t even seen a 38.2% retracement of the old high made back in late June 2008 (skewed by oil prices for sure, as they rallied to $147 per barrel; but also skewed by rising oil prices now).

| CRB Commodity Index: Thomson Reuters/CoreCommodity CRB Index is calculated using arithmetic average of commodity futures prices with monthly rebalancing. The index consists of 19 commodities: Aluminum, Cocoa, Coffee, Copper, Corn, Cotton, Crude Oil, Gold, Heating Oil, Lean Hogs, Live Cattle, Natural Gas, Nickel, Orange Juice, RBOB Gasoline, Silver, Soybeans, Sugar and Wheat. Those commodities are sorted into 4 groups, with different weightings: Energy: 39%, Agriculture: 41%, Precious Metals: 7%, Base/Industrial Metals: 13%. |

So, we have a lot more room on the upside if what we are witnessing is runaway inflation, and not just a global supply chain problem. Interestingly, from an Elliott Wave perspective, you can see an A-B-C pattern into the low in 2020, with the C-Wave made up of a clear five-wave move down. So, from a technical perspective, a bounce was due. But is it just a bounce, or the beginning of a major long-term wave up inflation?

Despite our belief inflation will fade over the next 6-12 months, we have to be open to the idea the US dollar may begin to be rejected as the world’s global reserve currency, and that would set the stage for a big run-up in the price of real stuff. That is a topic for another issue.

People keep repeating this mantra: Inflation is and always will be about the supply of money. We are sympathetic to that view, but the fact is it is about a lot more than money supply. Complexity abounds.

Inflation is also about:

- Debt

- Credit

- Economic productivity

- Global capacity

- Real wages

- Cross-border capital flows

- Global supply chains

- Contagion

- Feedback loops from financial asset markets to the real economy

- Psychology/expectations

- Velocity of money

- Debt service

Needless to say, we are not going to touch on all these items in this issue. They are great topics for the future. But we do want to make the case it’s just not about money.

We believe the deflationary forces in the US and global economy still point to subdued inflation and lower interest rates in the near future—we would define as six to twelve months out.

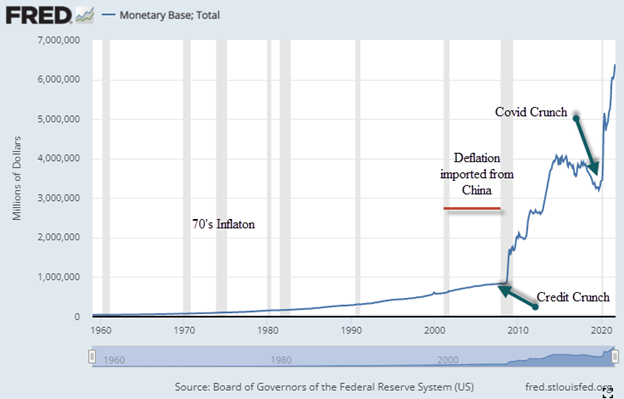

Often, to make the case for inflation, commentators flash the monetary base chart as you can see below, with our comments. Notice that during the US inflationary surge back in the 1970’s, it didn’t take a great deal of increase in the monetary base (though money was loose then via low real interest rates and government spending)? Of course, delinking the dollar from gold, i.e., ending the Bretton Woods monetary system by Richard Nixon in 1971, coupled with the overhang of fiscal spending on the Vietnam War and the Great Society, delivered inflation just the backdrop it needed—OPEC delivered the decisive blow back then.

It wasn’t just about the monetary base then, nor is it now is our belief.

The question is why hasn’t this incredible increase in the money supply caused inflation? Well, in short hand: You can lead a horse to water but you cannot make him drink. Let us explain.

The goal of all this money dumping into our economy, by our brilliant and corrupt political and central bank leaders, was supposed to stimulate the real economy; i.e., aggregate demand. Remember the series of events triggering the beginning of this avalanche of money was the Credit Crunch and the next wave came as a result of the Covid crisis:

- The US, and other Western economies, imported a lot of deflationary from Chinese in the late 1990’s and early 2000. Or to put it another way, China exported their excess capacity; i.e., all that stuff not consumed by the Chinese people—a major imbalance in their economy they are still working to fix. It was the Chinese/US symbiotic relationship. China sends real stuff to the US in shipping containers, the US wires them back fiat dollars via the SWIFT system. China then puts those same dollars into US government bonds, which further depressed artificially low interest rates. Low interest rates further supply consumers with fake wealth to buy more of China’s stuff.

- The US consumer benefited from low prices on everything from China, but as they did their manufacturing jobs (the higher paying ones for the middle-class) evaporated; real wages declined dramatically and have yet to recover. But it was easy access to credit, despite a decline in real wealth. A deadly combination. Mr. Consumer to still believed he is was doing okay. After all, he had an ATM machine—his house.

- In the background, the Fed was acting to stave off what it believed was a building dangerous deflationary environment; it led to an emergency zero interest rate in 2000 a la Fed “Drone” Alan Greenspan. One year prior, it just so happens the Glass Steagall Act of 1933 was repealed. That meant banks for the first time since 1933 would be allowed to get involved in the investment business, and not just take deposits and make loans. The banks, flush with new opportunities and all that money, got very creative, creating derivatives on top of derivatives on top of derivatives to the point of total farce; all that credit rocketed the housing market and stock market and made it easy for people with no credit to buy all kinds of stuff—houses and Chinese goods. The Chinese symbiotic relationship was in full bloom.

- This symbiotic relationship was severed by the credit crunch, which to a large part was created by this relationship in the first place. All those fancy derivatives proved not worth the paper they were printed on.

- The credit crunch proved to consumers they weren’t rich. But their housing wealth was a fantasy. It wasn’t real wealth. It was ephemeral, just as the housing bubble today driven by free money is not real.

- When the bubble broke, fiscal spending and bank reserves exploded upward as you can see in the chart. It was not inflationary because it was not used to bid up the price of real stuff, as there was no improvement in the real economy—think real wages.

- Instead, the huge increase in the money supply was used pay down debt, what remained, poured into financial assets because there were no competing dynamic growth opportunities in the real economy. The Covid crisis is a bit of a replay.

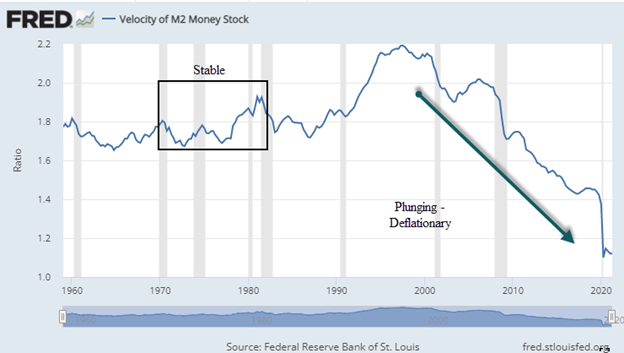

Keep in mind: High debt levels and lack of dynamic real growth opportunities depress the impact of the money supply. This can be seen in just one chart—it is called monetary velocity.

| The velocity of money is a measurement of the rate at which money is exchanged in an economy. It is the number of times that money moves from one entity to another. It also refers to how much a unit of currency is used in a given period of time. Simply put, it’s the rate at which consumers and businesses in an economy collectively spend money. |

Keep in mind the 70’s inflation as you view the chart below.

No doubt there was similar environment in the 70’s given the oil supply shock, thanks to the creation of OPEC. To mitigate the shock, we saw easy money, in the form of interest rates lower than the rate of inflation, and increased government spending (at a time when deficit spending was still considered risky—funny isn’t it). However, the difference in the 70’s was monetary velocity was stable so this spending did flow into the real economy bidding up prices. Additionally, labor was relatively strong, and demanded higher wages because of inflation. Again, with stable monetary velocity, these higher wages added to price pressures.

Now, labor is weak. Real wages remain at 30-year lows. There is no sign of rising worker power despite current shortages triggered by Covid. And monetary velocity continues to plunge, meaning the impact of the money supply increase is severely muted. And if we add on the fact that debt in all western countries has exploded since the credit crunch, and understand debt is a major drag on growth; you get the picture. For countries, companies and consumers, and the debt burden has grown to colossal proportions. And as you would suspect, every new dollar of debt created is less stimulative than it used to be. A bigger drag and less stimulative is not raw material for economic growth. At some point, growth will matter to the stock market.

The next shoe to fall, in our opinion is the stock market. Keep in mind the stock market is a repository of collateral values. At what point will a slowdown in the real economy and rising prices feed into earnings? Thought it didn’t det much ink, The Chicago Fed National Activity Index released yesterday showed the US economy lost momentum in September and clocked its lowest reading since April). When the market breaks, it will feed into the real economy further depressing growth and leading to default for highly levered players, and they abound (Evergrande Real Estate Company anyone).

Stay tuned.

Regards,

Gregor and Team…

| If you like what you see here and would like our Macro Views to be sent directly to your mailbox—free—just click on link below and register. Register for EW-Forecast Macro Views |