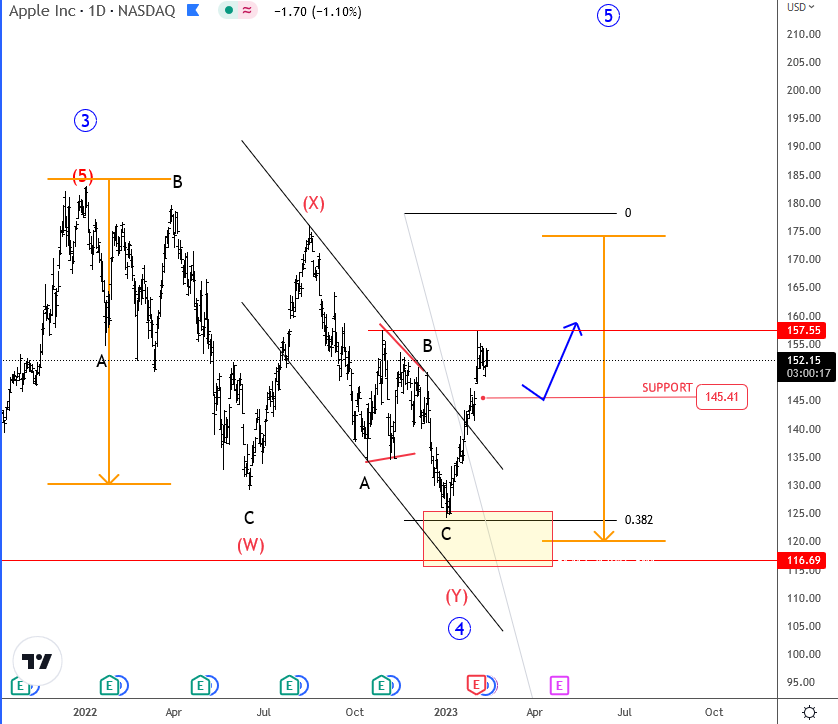

Apple is back to bullish mode, as we see sharp reversal and strong rebound after a completed complex correction by Elliott wave theory.

Apple was down in 2022, but slow price action and choppy + overlapped wave structure indicates for a corrective movement, so it’s ideally a complex 7-swing (W)-(X)-(Y) correction in higher degree wave 4. With recent sharp reversal and strong rebound from projected support, we believe that bulls are back to bullish mode and can send the price back to highs for wave 5 in the future.

Technically speaking, Apple found the support at a perfect area by textbook, where we see 38,2% Fibonacci support and equal wave length of (W)=(Y). Now that is turning sharply up, we believe that there’s room for more gains, just be aware of temporary short-term corrective pullbacks. Nice support is already around 145 level.

Aussie Slowed Down After A Wedge Formation. Check our article HERE