Welcome to our new weekend update in which I will cover some of the important data from the past and for the upcoming week, as well as the potential upcoming moves based on sentiment and Elliott wave patterns.

If you like this free analysis and review, and if you are running any free webpage and want this article to be re-published on your page or blog, let me know. You can send an email to info (at) wavetraders.com.

Grega

Next Webinar: “Elliott Wave Live” CLICK HERE

STOCKS AND FX

Last week, we have seen some nice bounce on US stocks, after the FED rates decision, when they hiked rates by 25bps, but looks like they are preparing to finish the hawkish cycle in the next few months. Strong jobs data reported on Friday suggests that there may not be a recession risk, especially not if they will really stop the hiking cycle. So, that’s why equities moved nicely higher, but for final speculations on further hikes, we need to see the US CPI figures on February 14. Keep in mind that inflation in Australia and Spain for example is not coming down yet, and if the US CPI would suddenly jump then stocks can be again on the “back foot” as FED will most likely remain hawkish until they achieve their goal.

From an Elliott wave and sentiment perspective I am aware of a potential turn down on stocks, but only for a short term as VIX trades at the extremes of 2022 levels. “No fear” can actually mean that the market is too optimistic, and this causes an unexpected move. In an ideal scenario, we will see a flat correction, with wave C bottom near 3800. However, a rise above 4335 will make me think that wave C/3 is already in play.

ECB and BoE also somehow sounded dovish. BoE has been constantly repeating the “recession risk” for the last few months. They said, that they could look for further tightening only if inflation gets worse. It appears they believe that inflation will come lower and that’s why the pound fell turned down for ongoing sideways consolidation on the GBPUSD chart, where I see the price in wave four.

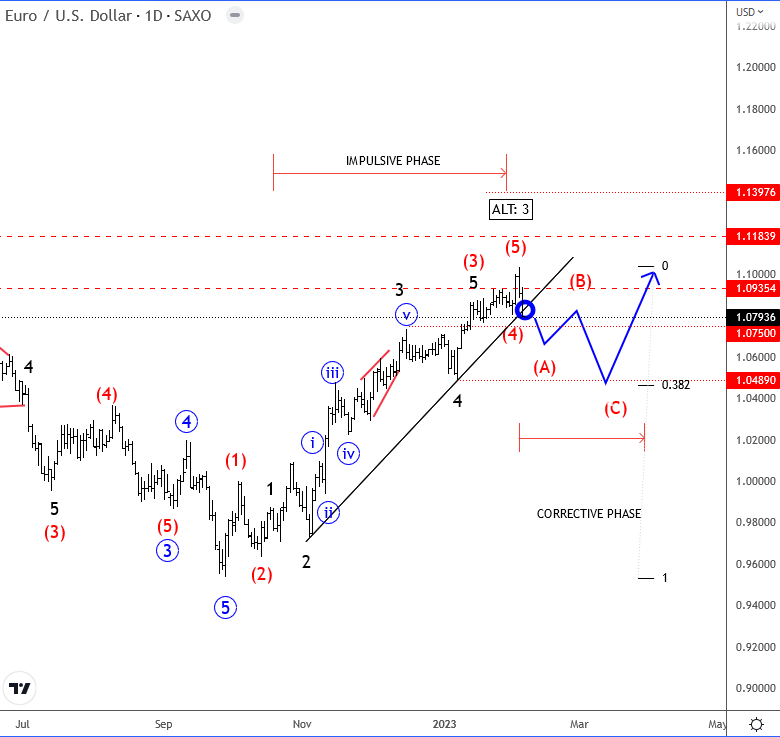

GBPUSD members update–CLICK HERE

ECB raised rates by 50bps to 2.5%, and already highlighted another 50bps increase for March, while the further hikes, after March, will depend on the data. So it appears that EURUSD reversal down came after “buy the rumor sell the news impact” which has been technically expected as we saw prices in a fifth wave of an Elliott wave pattern. We also saw large speculators moving into extremely long positions on the euro, so it’s not a surprise to see this reversal happening, since we know that the market moves in cycle form pessimism to optimism and vice versa.

From an Elliott wave perspective, we see a broken trendline after pair failed to break above 1.1 resistance. 200 and 100 W SMA also held as resistance in that fifth wave rally. Normally when there is a pullback, the correction can cause a retracement back to 50W SMA; ideal support would then be at 1.05, at the former wave four.

AUDUSD and RBA

In the past meeting, RBA said that if inflation data will worsen they will continue to take hawkish action. Well, the latest Australian CPI disappointed, it came up from 7.3% to 7.8%. That’s a big jump and a serious indication that inflation is “not a done deal” yet and that CB should do a lot more. There are expectations for a hike of 25bps from 2.85% to 3.10%. This outcome will not move the Aussie much then, but the pair can still find some buyers if RBA will highlight further hikes because of higher inflation. On the other hand, any dovish tone, and a similar one to BoE, ECB, and FED, will likely be bearish for the Aussie. Keep in mind that despite a need for a hawkish RBA call, CB follows each other and can take very similar actions.

From an Elliott Wave perspective, we see a correction in play, so higher degree recovery will resume from much lower levels. Nice support is at 0.66-0.67 area.

Click here for AUDUSD Elliott wave count

SILVER and USDCNH

Metals fell sharply as US yields turn up last week. However, the USDCNH is still seen in wave four, so if this one turns down next week, from around 6.84 resistance, then I think silver can stabilize. Metal came down a lot a few days back, after an unsuccessful break above the trendline connected from 2021 highs. But we still have to keep in mind that metals are in uptrend since Q4 2022, and that sooner or later this one may follow back to the upside after the current pause. Ideally, that’s wave four, now approaching a support, so the fifth wave up is still valid, especially if USDCNH will really come down as described above.

CRYPTO

Cryptos turned up as the dollar fell in the last few months, but we see DXY now moving into resistance here at 24-25k area, ideally with an extended wave 3, so wave 4 retracement can be in the cards, now when DXY is breaking the resistance line. Yes, I believe cryptos are back in bullish mode, but markets move in cycles, and it seems that new short-term cycle can be now to the downside before uptrend resume. Ideal support for a new bounce will be at 20300-2150.

Ok guys, that’s it. If you like what you see here and want more intraday and timely updates in next week, then make sure to check our premium services.

Trade well,

Grega

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Important data next week:

Monday

EUR Retail Sales 10GMT

Tuesday

AUD RBA rate decision 04:30GMT

USD FED Powell Speaks 17GMT

Friday

GBP UK GDP 07GMT

CAD Jobs data 13:30GMT

USD Inflation expectations and Consumer sentiment 15GMT

Interested in cryptos? Read what we have to say about Binance coin CLICK HERE