“The thought is not something that observes an inner event, but rather it is this inner event itself. We do not reflect on something, but, rather, something thinks itself in us.”

Robert Musil

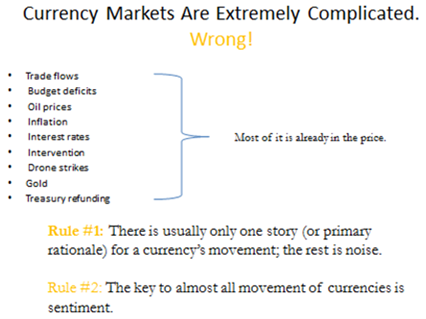

As you know, currency trading is not an easy game. But in a lot of ways, it is a simple game.

You buy or sell a pair. You then either exit with a gain, a loss or you breakeven. The hardest part is finding a reason to pull the trigger in the first place!

Many people believe they can forecast currency prices by getting the interest rate forecast correct (and are gearing up for the Fed Reserve Bank interest rate decision). But in reality, it’s a mug’s game. If we can forecast interest rates then why bother with currencies; we should just trade bonds on the Chicago Board of Trade and retire very wealthy.

That being said, there is meat when it comes to interest rates, and it flows from the yield and inflation differentials. It is these differentials that seem to be the basic fundamentals of currency analysis. Change in these differentials is what moves prices, and in currencies, changes in real yield differentials are a basic value benchmark.

Remember, the currency equation as we shared with you in our last issue:

↑Expected Total Return = ↑Interest Yield + ↓Inflation + ↑Future Exchange Rate

This equation says the primary rationale for holding a particular currency is to maximize total return. What we as currency traders are attempting to solve for it the Future Exchange Rate. And we know a surprise in interest rates (surprise hike or cut by a central bank; or surprise in degree of the rise or cut) are the things that move currency prices immediately.

But that is not the whole puzzle. The real yield component is embedded in the equation which is a function of the inflation rate. So, we can plug in the inflation rate for each local currency to degerming the real yield from holding said currency. Knowing this doesn’t shield you from a significant change in a country’s expected inflation rate.

And of course, we have to remember there are also two primary pools of global capital to consider when it comes to currency forecasting: 1) hot money (or speculative capital flow)—short-term flows of capital in search of the highest current yield; and 2) the portfolio (non-speculative capital flow)—this is long-term investment capital drawn to a particular country for multi-year opportunity. Of the two, at the margin, it is hot money flow that is the bigger driver of currencies in the time frames we trade.

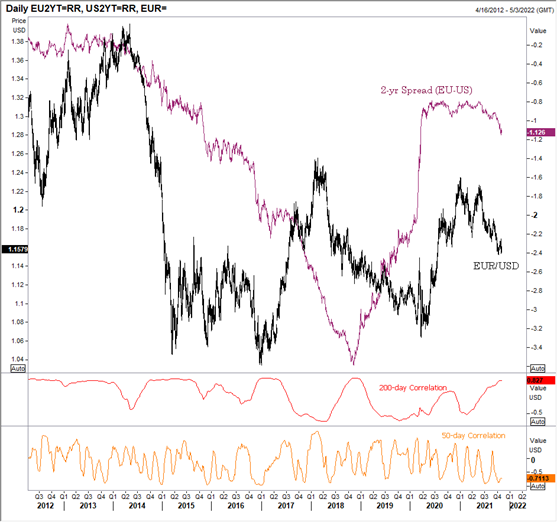

In the chart below we show the EUR/USD overlayed with the spread between the local currency 2-year benchmark yield and the US dollar 2-year benchmark yield (purple line). The bottom two panes are correlations.

Now some traders swear by these types of correlation. But to them we say “good luck.” We say that because what is perceived as a correlation, really isn’t much.

If you notice the middle pane of the chart above, it represents the 200-day correlation between the EUR/USD and 2-yr benchmark spread. It ranges from +92% to negative 80% since 2012. The lower box is the is the 50-day correlation, and that is all over the board.

The bottom line is this: Trying to forecast currency price action based solely on interest rate differentials is never as easy as many make it sound. Almost every other major currency correlation you can think of—gold, oil, stocks, etc.—display the same tendency. It proves again correlation is not causation.

Other than the differentials in real yield as a fundamental, causation is the same thing it has always been in all actively traded markets: real people moving real money for lots of different reasons; aka more buyers than sellers in an uptrend, and more sellers than buyers in a downtrend.

And it is for this reason we rely on the Elliott Wave Principle as our key forecasting tool. The Wave Principle, by its very nature, embodies the price action, or pattens of buying and selling in markets.

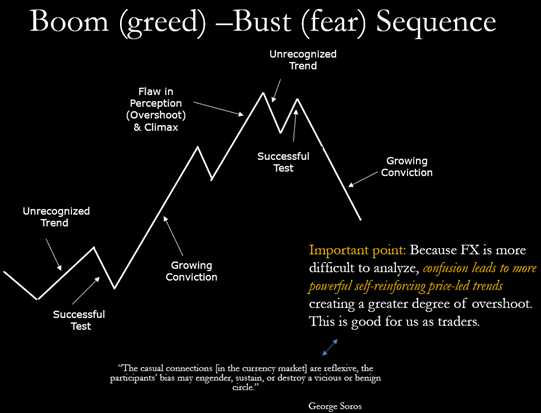

You can think of Elliott Wave as the mechanism that best identifies this tug of war between buyers and sellers as it plays out in all time frames. In short, this battle between buyers and sellers is a fractal boom-bust pattern. We have depicted it below:

The Wavetraders service is designed to guide our subscribers in an attempt to exploit these boom-bust cycles in differing time frames in order to build wealth in a trading/investment account. And the best way to do that, in our opinion, is through the Wave Principle.

No doubt, we should see some volatile price action on the release of the Federal Reserve Bank interest rate decision tomorrow as traders do their best to discern the impact on markets. The thing is, they don’t know what the Fed will do. And they don’t know how markets will react after the Fed says what it will do. Nor do we. But we do have a view and we let Elliott Wave be our guide.

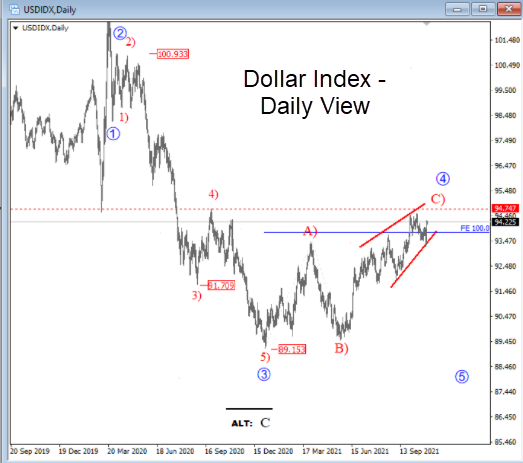

Below is our view on the direction of the dollar.

USD Index is in a recovery mode since start of the year but notice that index is retracing back the previous fourth wave area, as well as 2020 spike low. In fact, move into that region is so far with three waves from the low, plus a potential wedge in C. As such, we think that traders should be aware of a potential slow down of the DXY, especially if FED will again disappoint and delay with a tapering.

Daily Wave View:

You can learn more about us, and subscribe to our service at our website. We also have live customer chat support to serve you.

Regards,

Gregor and Team…

If you like what you see here, and would like our Macro Views sent directly to your mailbox, free, just click on link below and register.