NZDUSD is turning higher today as USD sees some weakness despite FED tapering announcement and strong US NFP figures on Friday. But let’s keep in mind that NZ jobs report was also strong last week so it’s not a surprise to see a jump on kiwi especially if we also consider that trend has already been strong ahead of both jobs reports, and plus, stocks are still in uptrend.

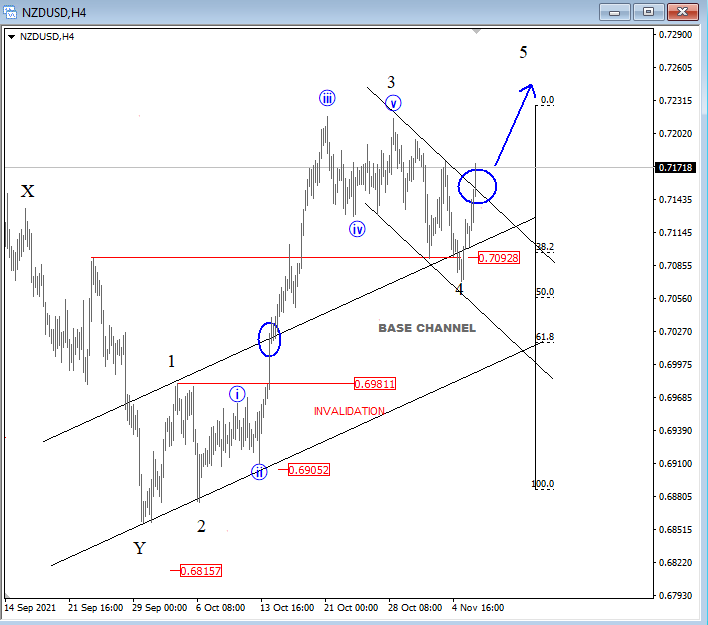

Pair found support around 0.7090 after a complex and slow pullback which we think it’s a correction as already discussed in one of our past video analyses (click here) . We see pair now recovery above the trendline resistance which normally suggests that the fifth wave has started and that pair can revisit a new high, ideally by the end of the week. But for now, the invalidation level remains at wave 1, as wave four must not trade into the territory of wave one in an impulsive sequnce.

Talk to you soon.

Grega

NZDUSD 4h Elliott Wave Analysis Chart

You like Elliott waves? Do you like cryptos? Check our update on Tron. CLICK HERE

Become a premium member

Get daily Elliott Wave updates for some major Digital currencies, FIAT currency markets, major stock indexes, gold, silver, crude etc. or apply for unlimited access to the Elliot Wave educational videos.