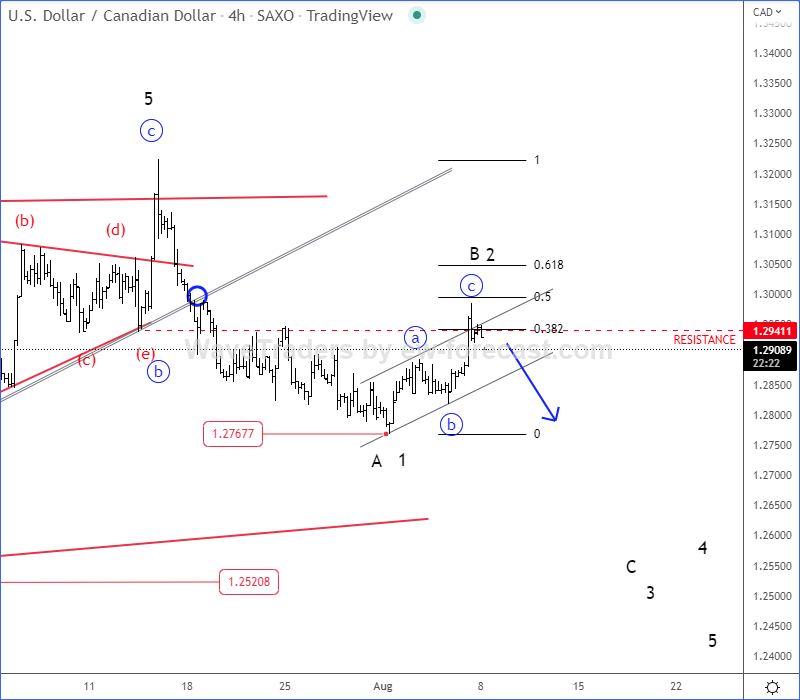

Hello traders, we have another important week for global markets as speculators are going to focus on CPI report from the United States, to see if prices are coming down or no. This data will be released on Wednesday. So, until then we may not see a log of changes regarding the current trends. We see still stocks in a strong recovery mode with room for more upside while USD can see a sell-off, especially vs commodity currencies which are very strong. AUD, NZD and even CAD can see more upside, despite lower crude oil. But, if crude would stabilize, we think that USDCAD is pointing lower and it has a very good chance to break the support.

From an Elliott wave perspective, we see three legs up, possibly already a completed correction on the intraday chart. Break below wave b swing near 1.2815 calls 1.27.

Grega

Check our previous USDCAD chart HERE.