“Nor dread nor hope attend

A dying animal;

A man awaits his end

Dreading and hoping all;

Many times he died,

Many times rose again …”

W.B. Yeats, Death

Russia’s attack on Ukraine represents a demand for a new world order

This is a very interesting blog post by Gail Tverber of OurFiniteWorld.com. It is an outside-the-box view on energy and geopolitics. In this pieces, Gail lays out some extremely interesting ideas about energy, price, debt, and the new world order (assuming Russia keeps from collapsing, Russia-China will be at the head of said new world order).

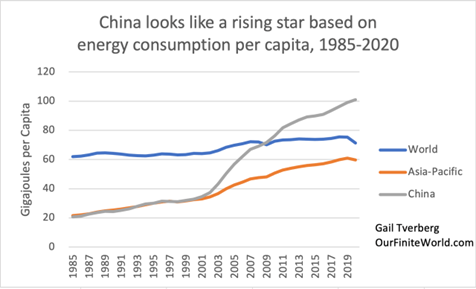

In Gail’s view, the key indicator of global economic success is “energy consumption per capita.” And as you can see in the second chart below, China is starting to pull away from the rest of the world.

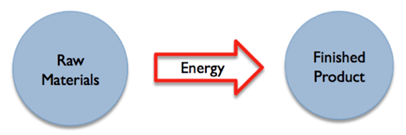

“As I see the situation, the underlying problem is the fact that, on a world basis, energy consumption per capita is shrinking. Energy consumption is essential for creating goods and services.

“The shrinking amount of energy per person means that, on average, fewer and fewer finished goods and services can be produced for each person. Some countries do better than average; others do worse. With low fossil fuel prices, Russia has been faring worse than average; it wants to remedy the situation with long-term higher energy prices. If Russia can start transferring its energy exports to China, perhaps the new Russia-China economy, with limited support from the rest of the world, can afford to pay Russia the high prices for fossil fuels that Russia requires to maintain its economy.”

[6] Europe, in particular, cannot afford high oil prices. If interest rates are increased soon, this will make the problem even worse. China seems to have definite advantages as an economic partner [for Russia].

“In recent years, China’s consumption of energy products has been growing very rapidly. Perhaps, in the view of Russia, China can use high-priced fossil fuel better than other parts of the world.”

For lessons on fighting inflation, skip Volcker and remember 1946

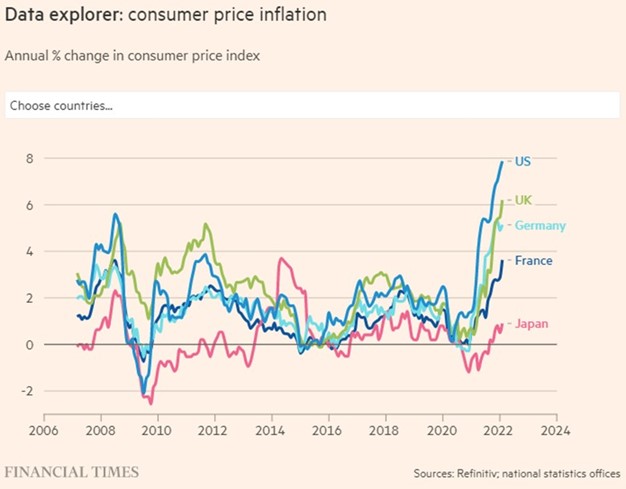

Guggenheim Partners chief investment officer, Scott Minerd, believes the Fed is on edge of a huge policy mistake that could push the economy into recession. We agree. Scott is a bit of an economic historian, and a very good financial economist in our book. He likens the current economic environment to the late 1940’s, not the 1970’s-80’s as we hear so often each day.

And because of this mistaken environment, Scott’s key point is this: If the Fed raises rates AND reduces its balance sheet at the same time, to fight a very scary looking inflation backdrop, the chances of a severe recession in the US rise dramatically.

“While that period’s inflationary rise may invite comparisons to today, its root causes — funding the Vietnam war and the Great Society social policy initiatives of Lyndon B Johnson, delinking the dollar from gold, and an energy crisis — were a different set of circumstances. A more appropriate corollary from history is 1946-48, the post-second world war inflationary episode resulting from supply shortages during peacetime refits of manufacturing plants, rebounding demand for consumer goods, high levels of savings and soaring money growth.

“This sounds a lot like today. As for how the 1940s inflation ended, supply and demand ultimately came back into balance, and a more primitive version of the Federal Reserve — which did not have the targeting of a benchmark fed funds rate in its toolkit — slowed the economy by curbing money and credit growth and shrinking its balance sheet.”

We continue to watch the yield curve for clues.

A dip into negative territory on the 2-10 spread (defined as benchmark US 10-year yield minus US 2-year yield) has a great track record of predicting recession, and a stock market correction.

Recession will change the market dynamics. Bond yields will come in quickly. And given the global growth backdrop (Europe losing growth momentum and China facing some severe problems), we would expect stocks to feel the brunt and stage a significant correction lower.

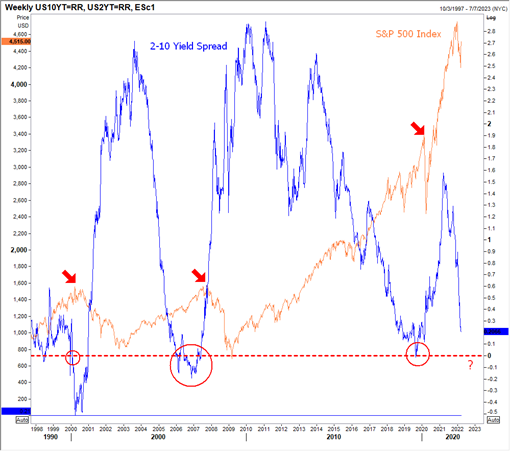

S&P 500 Stock Index (orange) vs. US 2-10-yield spread Weekly (blue): We have circled in red the times when the spread went negative; the red arrows show stock market corrections appear correlated to negative spreads. The spread is heading sharply lower at the moment.

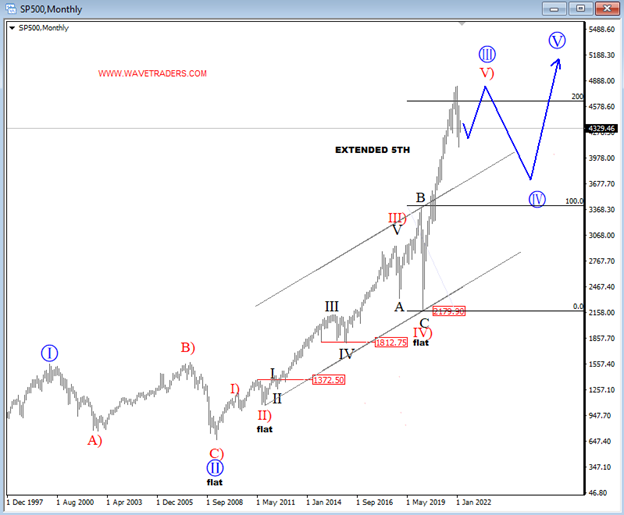

Our Monthly Wave View on the S&P 500, we are looking for a decent correction in stocks, after a move higher near-term:

And the US 10-year note, monthly basis, is approaching key long-term support. So we would be looking for a bounce in this area. A US recession would create a sizeable bounce higher in bonds (yields lower).

Though too soon to say a near-term bottom is in place in the 10-year. But we are looking for a rally in bond prices back toward the 130-level when the correction in larger Wave IV begins.

And speaking of recession…

ECB to weigh more bond buying if war crashes economy

In a Reuters story from yesterday, ECB board member Isabel Schnabel (considered the most hawkish member of the ECB board) is talking easing in the face of pressures on the economy flowing from Ukraine. This would be an about face for the ECB, and something we have alluded to in our piece on the dire energy situation facing Germany.

“The European Central Bank would consider extending its money-printing programme beyond this summer if the euro zone economy fell into a ‘deep recession’ because of the conflict in Ukraine, ECB board member Isabel Schnabel said on Thursday.”

The fact is European growth is already showing signs of deceleration. All in all, when comparing the already huge positive 2-year yield spread in favor of the US dollar, versus the Euro, the idea of more ECB easing cannot be good for the Single Currency.

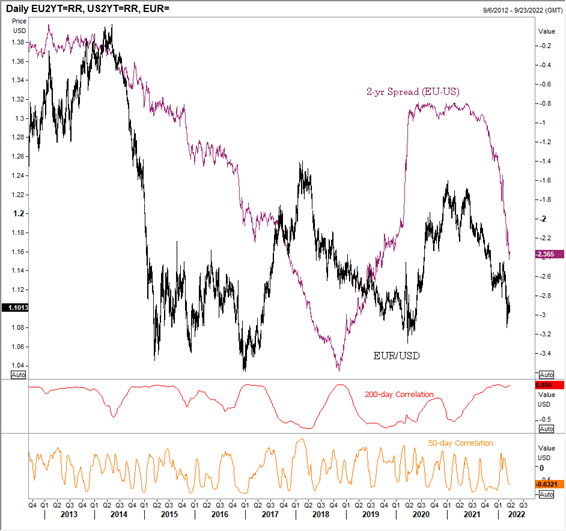

2-year Benchmark Eurozone yield minus US 2-yr yield (purple) vs. EUR/USD (black) and related correlations between said spread and EUR/USD.

As you can see, relative 2-year US yield is now 236 basis points higher than the equivalent Eurozone yield. Over the last eight months EUR/USD has moved in line with the spread.

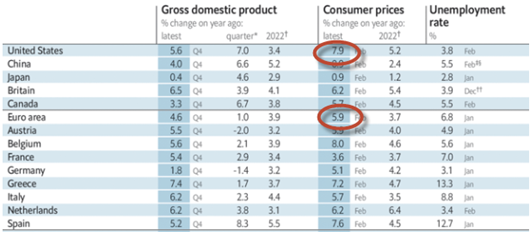

On a real yield basis (factoring in higher relative US inflation rates, it presents a different picture). From the Economist below showing US CPI at 7.9% versus 5.9% for the Eurozone:

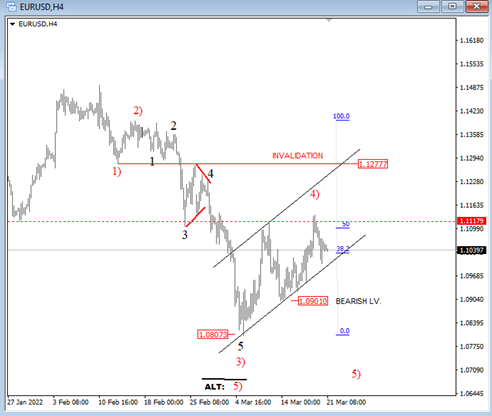

We are not sure that matters given the aggressiveness of the Fed and continued safe-haven status for the dollar. Below is a look at our latest Wave View on EUR/USD—this is a 4-hour chart view—we are bearish on the pair with scope back toward 1.0700-level:

How refugees’ need for cash exposes the limits of Euro sovereignty

The euro may be poised to head lower against the USD dollar, but it doesn’t matter to Ukrainian refugees. Those fortunate enough some of their currency—the hryvnia—are unable to exchange it into euros. Adam Tooze examines the financial plight of Ukrainian refugees on his Substack—Chartbook.

The inertia from the ECB is stunning really. It highlights one of the many flaws of the European Union structure.

“So this is the dilemma: Europe is not giving up on Ukraine. It is determined as far as possible to preserve the belief in an unimpaired Ukrainian monetary sovereignty. And it clings to that idea even as millions of Ukrainians are desperately fleeing their country and in doing so fleeing its currency. They need out.

“Presumably the hope is that at some point in the future Ukraine will be restored and normal financial and monetary relations can resume. In the mean time a painful tension must be bridged. This will require money, from Europe. And that is where the problem starts.”

“…Fear of monetary sovereignty is, once again, the problem.

“As another ECB source remarked to Balazs Koranyi and Jan Strupczewski of Reuters: remarked: “This would be a humanitarian, goodwill effort, rather than a regular policy instrument, but we are still bound by laws so it’s not like we could just say, come, we’ll covert it for you [convert hryvnia to euros].”

Below is a weekly chart comparing the Ukrainian currency to the US dollar…the ugliness began with the war and change of government back in 2014.

India-Russia currency swaps bypass US sanctions

Writing in the Asia Times, David Goldman discusses the implications of currency swaps in place to finance trade in rupees and rubles, bypassing US sanctions. India is eager and so is Russia. Interestingly, the US sanctions have not targeted India. That’s no surprise. If the US loses India, its defense against a growing China weakens tremendously.

“The US sanctions regime doesn’t extend to Russia’s oil and gas shipments to Europe and Asia, which earn Moscow more than $1 billion a day. And Russia customers do not need to seek alternative financing mechanisms. The India-Russia swap, though, is an open break with the dollar regime.

“Saudi Arabia reportedly is considering accepting China’s RMB as payment for oil, but the Gulf countries have released no information on non-dollar oil payments.

“India has been an aggressive buyer of Russian oil, reportedly at discounted prices. News media cite a two-million-barrel sale to Hindustan Petroleum and a three-million-barrel sale to Indian Oil, although the true totals aren’t known.

“Asian countries now have $380 billion of local-currency swap lines, which allow importers and exporters to pay in their own currencies rather than in US dollars in case of need. The balance of trade would then be settled by transfers among central banks in any acceptable reserve asset, including US dollars or gold. These swap lines remain inactive, as an emergency backup system. But Asian central banks have been eager to expand them. Japan’s central bank is a strong advocate of swap line expansion, according to Asian government sources.”

Clearly, dollar hegemony is in trouble. We discussed this in greater detail in our last Macro missive if interested.

And finally…

Is China Helping Russia Hide Money? The Kremlin May Have Stashed Billions in Offshore Accounts

Ben Steil and Benjamin Della Rocca explain why Western financial sanctions may not stop Mr. Putin from using his war chest of dollar reserves because much of it is in offshore accounts bypassing sanctions. They contend China likely assisted Russia in this endeavor. (Russian reserves were estimated $630 billion at the start of the war).

This goes to the point: What you see in the headlines isn’t how the real world really works.

“It is not yet clear which intermediaries Russia would have used to stash Treasuries offshore. One strong possibility, however, is China, with which Putin now appears allied. In December 2021, at the same time that Belgium’s Treasury holdings surged by $47 billion. Russia’s central bank reported a massive $41 billion increase in its currency and deposits held at “other national central banks”. That jump dwarfed all other monthly changes in this statistic since Russia began reporting it in 2005. And the most likely recipient of those deposits is the PBOC.

“The Russian central bank and sovereign wealth fund hold an estimated $140 billion in Chinese bonds—about four times the total in early 2018. Data from June 2021 also show China holding 14.2 percent of Russia’s foreign reserves, the largest share of any country. And their partnership extends well beyond the financial arena: late last year. Russia and China held a series of joint military exercises and issued joint diplomatic statements aimed at the West. It would make sense, therefore, for Russia to deposit $41 billion in renminbi or assorted currencies with the PBOC. The PBOC could have then exchanged the currencies for dollars, crediting Russia for a $41 billion deposit, and used the dollars to buy Treasuries for storage at Euroclear. Therefore, Chinese President Xi Jinping, who just last week condemned Western sanctions as ‘harmful to all sides,’ appears fully supportive of that sort of maneuvering.”

———–

Happy Trading. Stay tuned. And be careful out there.

If you like what you see here, you can learn more about us, and subscribe to our service at our website. We also have live customer chat support to serve you.

Regards,

Gregor and Team…

If you like what you see here, and would like our Macro Views sent directly to your mailbox, free, just click on link below and register.