Macro Views

Quotable

“I went to Savannah to meet the world and all I met was a tyrant.”

John Maynard Keynes, referring to the US Officials at the IMF-World Bank meetings in Savannah, GA 1946

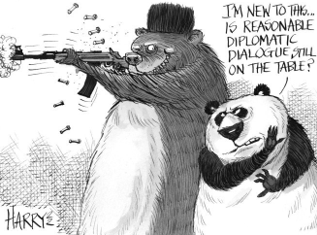

Dollar hegemony in jeopardy as the US pokes the bear

Editor Note: Our alternative title was: With friends like the US, Europe doesn’t need enemies…

Regardless of what one knows and believes about Russia, it’s almost inconceivable (though no longer), the US Administration would treat a country with the nuclear capability to wipe them off the map in about 15-minutes with such utter disdain, and treat its allies as cannon fodder in the process.

The 2014 U.S.-backed coup that overthrew President Viktor Yukanovych, solidly supported by the east of the country. Brought to power pro-West forces determined to bring Ukraine into NATO, whose designation of Russia as prime enemy had become ever more blatant. This caused the prospect of an eventual NATO capture of Russia’s major naval base at Sebastopol, on the Crimean peninsula.

Russia quickly dealt with that Crimea problem, and now is dealing with the rest of it.

Back in 2014, when the turmoil increased dramatically for Ukraine, one of the US’s stellar neo-con diplomats, Victoria Nuland, was in country to support the overthrow of President Yukanovych. An audio of a conversation surfaced, whereby discussing coup options with another US diplomat, said diplomat expressed concern about how the European Union might respond to various options. Nuland, in her most diplomatic of diplomatic language, said “F—k the European Union.” An honest view on how much respect the US has for its European allies. Her utter failure in Ukraine was of course rewarded by President Biden. He appointed Nuland as Under Secretary of Political Affairs in April 2021. Incredibly, she is back on the job spreading peace and love wherever she goes.

Look how well US meddling worked out for Ukraine since the 2014 coup (Olga Sukharevshaya- How Ukraine’s ‘Revolution of Dignity’ led to war, poverty and the rise of the far right):

Ukraine’s military spending is now more than eight times higher than it was back in 2013. But the economy on the whole is in a deepening recession. In 2021, Ukrainian GDP stood at a record $195 billion (compared to $182 billion in 2013), but that was negated by inflation. When it came to certain goods, consumer inflation reached 11%, hitting a record high in the past three and a half years. The CEO of the CASE Ukraine think tank, Dmitry Boyarchuk, points out that, “in a number of areas, this growth is in name only: the prices on our exports were simply higher than the prices on our imports. But in terms of volume, our exports have been shrinking. We produce exactly as much as before, if not less, but we earned more because of the prices in the global markets.”

At the same time, the debt has been growing. In 2013, Ukraine’s external debt amounted to $27.9 billion, but by the end of 2021, it had reached $47.7 billion.

Ukraine has been gradually transforming from an industrial and agrarian country into a raw-materials supplier. In 2013, machine-building exports accounted for 18.9% ($12.9 billion), while, in 2017, they were down to 9.9% ($4.3 billion). The foreign trade structure for 2021 confirms this trend. Ukraine’s top exports last year were ferrous metals ($13.95 billion, up 81.4% compared to 2020). Grains ($12.34 billion; +31.2%) and animal and vegetable fats and oils ($7.04 billion; + 22.5%). As for the imports, apart from energy resources, Kiev needs machines and equipment ($14.2 billion; +22.9%). As well as products of the chemical and related industries ($9.74 billion; +32.8%). It is ironic that the US ambassador said Ukraine must become an agrarian superpower. The “granary of the USSR,” as Ukraine was once known, is now importing more and more food. In 2021, it imported $8 billion worth of food products (+19% compared to 2020).

At the same time, we’re seeing deindustrialization. In 2014, the Lvov Bus Factory was closed, and, in 2018, bankruptcy proceedings were initiated over the Zaporozhskiy Automobile Building Plant. In 2016-2019, the Antonov aircraft manufacturer didn’t produce a single plane. July 2021, the Nikolayev Shipyard – once a key part of the Soviet shipbuilding industry – was officially closed. Yuzhmash, a large aerospace and rocket factory, has been barely staying afloat since 2014. In 2013, 50,449 cars were manufactured in Ukraine, but, by 2021, the number had decreased to 7002.

Living standards are also falling. Utilities rates keep rising, and, as of now, the utilities debt has reached $3 billion, owing to International Monetary Fund (IMF) requirements. Ukrainian political analyst Vladimir Chemeris explains that “the tariffs will keep rising. Back in summer 2020, our government signed a memorandum with the IMF, agreeing that gas prices should be fully market-determined. Market price means higher price. The IMF also underlined this requirement time and time again, and our government agreed, hoping for more and more loans to at least pay off the previous ones.”

Having terminated its gas supply contracts with Russia, Ukraine has had to deal with an energy crisis. On top of that, Kiev has to pay more for gas than even the EU countries. In October, gas prices across the EU ranged from €300 to €700, while, in Ukraine, it reached €1,100.

And so Ukrainians are leaving the country en masse. In 2020, 601,200 received EU residence permits. According to the Ptoukha Institute of Demography and Social Studies, in 2021, the number of migrant workers stood at 2.5 to 3 million people. While 1,068,000 Ukrainians obtained Russian citizenship in 2014-2021. In the first 10 months of 2021, the population outflow exceeded 600,000 – a record high in the past 11 years.

French President Macron is on to the game, having said NATO (read the United States) is “brain dead.” But, despite his latest diplomatic efforts to stave off the current conflict, he got no support from Germany, as it caved to the US. (We can only wonder what kind of pressure the US put on Germany to abandon the Nord Stream II pipeline; ensuring all German citizens will suffer accordingly; now having to import high-priced Liquid Natural Gas from the United States and elsewhere.)

Okay. There is a reason the US is so publicly strong-arming its allies and outright dismissing (and lying about) Russian security concerns. From Michael Hudson, writing in the Unz Review (our emphasis):

The sanctions that U.S. diplomats are insisting that their allies impose against trade with Russia and China are aimed ostensibly at deterring a military buildup. But such a buildup cannot really be the main Russian and Chinese concern. They have much more to gain by offering mutual economic benefits to the West. So the underlying question is whether Europe will find its advantage in replacing U.S. exports with Russian and Chinese supplies and the associated mutual economic linkages.

What worries American diplomats is that Germany, other NATO nations and countries along the Belt and Road route understand the gains that can be made by opening up peaceful trade and investment. If there is no Russian or Chinese plan to invade or bomb them, what is the need for NATO? What is the need for such heavy purchases of U.S. military hardware by America’s affluent allies? And if there is no inherently adversarial relationship, why do foreign countries need to sacrifice their own trade and financial interests by relying exclusively on U.S. exporters and investors?

How ironic, through its own incompetence, the US has pushed Russia deep into the arms of China. This means any Western sanctions against Russia will be muted at best, and likely completely useless (thus far, existing Western sanctions have only made Russia and China even more independent). Russia can sell all the gas it wants to Asia. Russian can get all the technology it needs from China. Russia’s advanced weapons program will not be compromised. Russia has a massive store of foreign reserves and gold and can print its own currency if need be. It doesn’t really need the Western financial system.

This is what makes UK’s bumbling Boris’ idea of a Society for Worldwide Interbank Financial Telecommunications (SWIFT) sanction so much more entertaining. And if the UK’s plans to eject Russia from SWIFT–the electronic funds transfer system allowing banks to transfer funds anywhere around the globe—is agreed upon, the unintended consequence might do more damage to Europe. As it will have to pay for its current supply of Russian gas (not yet cutoff) in Rubles. Great idea Boris. We are sure the Dementia-laden President of the United States Joe Biden, will love it.

Back to Mr. Hudson:

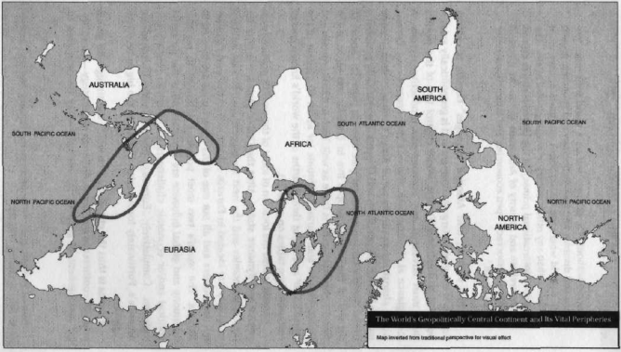

America’s rising pressure on its allies threatens to drive them out of the U.S. orbit. For over 75 years they had little practical alternative to U.S. hegemony. But that is now changing. America no longer has the monetary power and seemingly chronic trade and balance-of-payments surplus that enabled it to draw up the world’s trade and investment rules in 1944-45. The threat to U.S. dominance is that China, Russia and Mackinder’s Eurasian World Island heartland are offering better trade and investment opportunities than are available from the United States with its increasingly desperate demand for sacrifices from its NATO and other allies.

A read of former National Security Adviser in President Jimmy Carter’s administration Zbigniew Brzezinski’s book, The Grand Chessboard, the bible for the US foreign policy establishment would help clarify why the US is doing what it is doing. Chapter two, titled The Eurasian Chessboard, first three paragraphs, we read (our emphasis):

FOR AMERICA, THE CHIEF geopolitical prize is Eurasia. For half a millennium, world affairs were dominated by Eurasian powers and peoples who fought with one another for regional domination and reached out for global power. Now a non-Eurasian power is preeminent in Eurasia—and America’s global primacy is directly dependent on how long and how effectively its preponderance on the Eurasian continent is sustained.

Obviously, that condition is temporary. But its duration, and what follows it, is of critical importance not only to America’s wellbeing but more generally to international peace. The sudden emergence of the first and only global power has created a situation in which an equally quick end to its supremacy—either because of America’s withdrawal from the world or because of the sudden emergence of a successful rival—would produce massive international instability. In effect, it would prompt global anarchy. The Harvard political scientist Samuel P. Huntington is right in boldly asserting:

A world without U.S. primacy will be a world with more violence and disorder and less democracy and economic growth than a world where the United States continues to have more influence than any other country in shaping global affairs. The sustained international primacy of the United States is central to the welfare and security of Americans and to the future of freedom, democracy, open economies, and international order in the world.1

In that context, how America “manages” Eurasia is critical. Eurasia is the globe’s largest continent and is geopolitically axial. A power that dominates Eurasia would control two of the world’s three most advanced and economically productive regions. A mere glance at the map also suggests that control over Eurasia would almost automatically entail Africa’s subordination. Rendering the Western Hemisphere and Oceania geopolitically peripheral to the world’s central continent.

About 75 percent of the world’s people live in Eurasia, and most of the world’s physical wealth is there as well, both in its enterprises and underneath its soil. Eurasia accounts for about 60 percent of the world’s GNP and about three-fourths of the world’s known energy resources.

Continuing US dominance is slipping away despite Mr. B’s pleas.

And none other than Vladimir Putin has known this for a long time. Thus, he had to be demonized by the US “foreign policy-Pentagon-Congressional-defense company-media company—Wall Street complex,” the crowd who benefits most from US as global hegemon; even though the plebs in fly-over country pay the price in taxes, while US economic efficiency fades away and non-elite opportunities fade away.

Vladimir Putin’s famous speech in 2007 at Munich’s Conference on Security Policy (our emphasis):

I consider that the unipolar model is not only unacceptable but also impossible in today’s world. (Rhut Rho!) And this is not only because if there was individual leadership in today’s—and precisely in today’s—world, then the miliary, political and economic resources would not suffice. What is even more important is that the model itself is flawed because at its basis there is and can be no moral foundations for modern civilization. Along with this, what is happening in today’s world—and we just started to discuss this—is a tentative to introduce precisely this concept into international affairs, the concept of a unipolar moment.

(We forgot to mention technology, in the form of hypersonic weapons of which Russia and China are ahead of the US, seems to be at a stage providing land power—Russia’s key strength—a definite advantage over sea power—US’s key strength. Think of US Carrier groups, once the ultimate way to project power, as ducks on the pond if the US cannot shoot down hypersonic missiles—which at this writing, it can’t.)

If you add this insolence from Mr. Putin, to the fact he thwarted the ongoing “Rape of Russia” which began in the mid-1990’s. Having the audacity to want his country controlled by Russians, instead of being dominated by Western financial institutions. He therefore becomes enemy number one on the US hitlist (Mr. Xi is second at the moment, but he too will pay the price for not wanting his country taken over by Western financial elites). (See Harvard Mafia, Andrei Shleifer and the Economic Rape of Russia.)

Below an excerpt from Anne Williamson’s comments, Speaking before the Committee on Banking and Financial Services of the US House of Representatives, September 21, 1999 about the US “Rape of Russia” in the mid-90’s when Yeltsin took “charge.”

- The first mistake was the West’s perception of the elected Russian president, Boris Yeltsin; where American triumphalists saw a great democrat determined to destroy the Communist system for freedom’s sake, Soviet history will record a usurper. A usurper’s first task is to transform a thin layer of the self-interested rabble into a constituency. Western assistance, IMF lending and the targeted division of national assets are what provided Boris Yeltsin the initial wherewithal to purchase his constituency of ex-Komsomol [Communist Youth League] bank chiefs, who were given the freedom and the mechanisms to plunder their own country in tandem with a resurgent and more economically competent criminal class. The new elite learned everything about the confiscation of wealth. But nothing about its creation. Worse yet, this new elite thrives in the conditions of chaos and eschews the very stability for which the United States so fervently hopes knowing full well, as they do, that stability will severely hamper their ability to obtain outrageous profits. Consequently, Yeltsin’s “reform” government was and is doomed to sustain this parasitic political base composed of the banking oligarchy.

- When the Administration says it had no choice but to rely upon the bad actors it did select for American largesse, Congress should recall Larisa Piasheva. How different today’s Russia might have been had only the Bush Administration and the many Western advisers from the IMF, the World Bank, the International Finance Corporation, the European Bank for Reconstruction and Development and the Harvard Institute of International Development then on the ground in Moscow chosen to champion Ms. Piasheva’s vision of a rapid disbursement of property to the people rather than to the “golden children” of the Soviet nomenklatura.

- Instead, after robbing the Russian people of the only capital they had to participate in the new market – the nation’s household savings – by freeing prices in what was a monopolistic economy and which delivered a 2500% inflation in 1992, America’s “brave, young Russian reformers” ginned-up a development theory of “Big Capitalism” based on Karl Marx’s mistaken edict that capitalism requires the “primitive accumulation of capital”.

- The CIA has determined that through Nordex, FPI seized the export earnings from Russia’s natural resource companies – oil, gas, platinium, gold, diamonds – and from industrial firms exporting items such as steel and aluminum and then stashed the hefty profits in Western bank accounts. And only now, eight years almost to the day later, do US taxpayers learn that the “eager, young reformers” to whom their resources were sent for the purpose of building a new Russia were in league from day one with the exhausted Soviet nomenklatura in a scheme to loot Russia’s wealth and park it in the West.

- The ascendancy of Treasury in foreign policy at the State Department’s expense is the result of a neo-mercantilist foreign policy in which enterprise is to be subject to direction from the presidential administration it is to serve. By expanding the mandates and accelerating the use of a host of international agencies in which the US is dominant – the IMF, the World Bank, the EBRD, the regional development banks, the IFC – and combining their efforts with those of the Commerce Department, the Export-Import Bank, OPIC and USAID-financed Enterprise Funds, the Clintons succeeded in constructing an international patronage machine in which the American executive stands supreme.

- “The new paradigm” economy concocted by the Harvard-connected Clinton Administration appointees in the U.S. Treasury, was designed to extend the federal government’s meddling hand worldwide through its control of the multilateral and bilateral public lenders, enabling government a free ride on the back of a re-structured U.S. economy grown vigorous and ever more innovative on account of the benefits the Reagan era’s low taxation, moderate inflation, reduced regulation and expanding world trade had delivered. The overall scheme works as follows:

Sell assistance programs on an alleged “free market” and “humanitarian” basis by awarding government grants to those academics who can be relied upon to supply the intellectual camouflage politicians and journalists then repeat ad nauseum to a distracted public. Move the IMF and the World Bank to target, induce target to raise taxes, fine tune target’s central banking operations, encourage borrowing and debt creation through the target’s government and its national banks. Allowing IMF lending to pay yields if necessary; induce target to privatize national property while building a flimsy, artificial “infrastructure” for an equities market good enough to attract high risk foreign investors. Once the target nation’s government flounders, step back and watch speculators assert discipline through a run on the target’s currency. The subsequent devaluation delivers, in turn, a flood of cheap imports to American manufacturers and producers.

- The finishing touch on the swindle is to confiscate more money from G-7 citizens (the lion’s share from Americans) to pay for what is said to be an “essential” IMF bailout; thereby allowing Uncle Sam’s IMF minions to entrench themselves more deeply in the target’s government. Taxes are raised, the population struggles beneath indebtedness, government funding demands and the inevitable domestic inflation a devaluation delivers. Western neo-colonialists then bully the target over its rapidly compounding debt in order to extract yet more property. Once successful, the world’s insiders then turn around and deliver cheap shares from privatizations and initial public offerings into the maw of U.S. mutual funds and portfolio investors. US taxpayers get hit coming (foreign aid) and going (bailouts) and innocent foreigners’ property is finagled away either from, or on account of, inattentive and corrupt leaderships. The big winners are the world’s increasingly corrupt and cozy governing class, international bureaucracies and global banks.

*Sidenote of interest. It was none other than former Israeli Central Bank Chief and Vice-Chair of the US Federal Reserve Stanley Fischer who was the point man at the IMF directing the Western “recovery” of Russia at the time. And his trusty assistant was none other than the ubiquitous Mohamed El-Arian (ex-PIMCO boss and commentator extraordinaire. And the Harvard Boys were run by the always-confident Larry Summers (former US Treasury Secretary). Corruption runs deep in the financial world, and it is rewarded accordingly.

Gee. One wonders why Mr. Putin would want to decline all that help the US was providing.

Nothing has changed in the way the US does business. In fact, the corruption, in this writers opinion, has only increased over the years since the “Rape of Russia” as the power of global financialization has grown more pervasive. But, remember, the ends justify the means as the US has a duty to “save the world from itself” by maintaining dominance over Eurasia.

The point is, the US engineered attack on the Ukraine has little to do with Ukraine—the country is pawn. Poking of the Bear is about maintaining US hegemony. It is about the US dollar dominance. Effectively, this is the macro meat on the bones rationalizing our longer-term view on the US dollar.

By why is war good for the US dollar? A good question. And to provide that answer, we thought you might enjoy this unique insight from Chinese General Quio Liang . Delivered at the University of Defense, a top Chinese military school. You can find his complete views on the history of US monetary policy and Chinese strategy as a rising power challenging the US here.

The secret that American soldiers fight for the US dollar

(General Liang has four key points, we share the first two here. You may read the other three as linked above.)

1. The Iraq War and the currency used in accounting oil deals

Everybody says the power of America rests on three pillars: money, technology, and military. In fact, today we can see that the real pillars of the US are monetary and military, and supporting the currency is the United States military. Wars all over the world burn money, but the US military goes on fighting despite it. But it can burn money on one hand and earn money for the US on the other hand, which other countries cannot do. Only the United States can gain a great deal through war. Although the United States also has lost some hands.

Why did the Americans fight in Iraq? Most people have in mind just one word: oil. Did Americans really go to war for oil? Definitely not. If Americans went to war for oil, then why didn’t the Americans take a single barrel of oil from Iraq after the victory? Moreover, oil prices went from $38 a barrel before the war, to $149 a barrel after the war. The American people did not get low oil prices because of the US occupation of Iraq. Therefore, the US war in Iraq is not about oil, but the dollar.

Why, you say? The reason is very simple. Because in order to control the world, the United States needs the world to use dollars. In order to let the world use dollars, the Americans made a very clever move in 1973: they linked the dollar and oil by forcing the leading OPEC country, Saudi Arabia, to conduct its global oil transactions in dollars. If you understand that global oil transactions are in US dollars, you can understand why the Americans fight for oil. A direct consequence of war in the oil-producing countries is the surge in oil prices, and a surge in oil prices means that the demand for dollars increases.

Before the war, for example, if you had $38, in theory, you can buy a barrel of oil from an oil company. With the war, oil prices have more than quadrupled, reaching $149. So, $38 is only enough to buy a quarter of a barrel of oil, and for the remaining 3/4 of the barrel you are short more than 100 dollars. What to do then? You can only go to the Americans with your own products and resources and hand them out in return for American dollars. And then the US government can confidently, openly, and justifiably print dollars. It is through war—war against the oil-producing countries creating high oil prices—that the US creates a high demand for dollars.

The American war in Iraq had more than just one goal. It was also about maintaining the dollar leadership. Why then did George W. Bush insist on war in Iraq? Now we can very clearly that Saddam did not support terrorism or al-Qaeda, nor did he weapons of mass destruction—why was Saddam finally brought to the gallows? Because Saddam thought himself smart, and played with fire with superpowers. At the official launch of the euro in 1999, Saddam Hussein seized the opportunity to play with fire between the dollar and the euro—the United States and the European Union—and he could not wait to announce that the Iraqi oil transactions would occur in euros. This is what angered the Americans, in particular, it produced a chain reaction.

Russian President Vladimir Putin, Iranian President Mahmoud Ahmadinejad, and Venezuelan President Hugo Chavez, also announced the settlement of their country’s oil exports would be in euros. Was this not a stab in American backs? Some people think it is too far-fetched to say that after this war in Iraq was mandatory. Then please take a look at this: what did the Americans do after winning Iraq? Even before seizing Saddam, the Americans set up an Iraqi interim government whose first decree was to declare Iraqi oil exports would be accounted in dollars and not in euros. That’s why Americans are fighting for dollars.

2. The Afghan war and US capital account surplus

Some might say that the war in Iraq to for fight US dollars is understandable, but in Afghanistan there is no oil, so the US war in Afghanistan could not have been fought for the dollar, right? Moreover, the war in Afghanistan came clearly after “9/11,” when the United States wanted to retaliate against al-Qaeda and the Taliban for supporting al-Qaeda. But is that really true? The war in Afghanistan started over a month after “9/11″—it was kind of rush. After a while the US ran out of cruise missiles but the war still continued.

The Pentagon could not but order open the stash of nuclear weapons, remove the 1,000 nuclear warheads from cruise missiles, and put in place conventional warheads. Then they lobbed 900 more missiles and only then beat down Afghanistan. This is obvious proof that preparation was very inadequate, and in that case, why did the Americans insist on rushing into battle?

Americans could not wait any longer. In the early 21st century, the United States was an industrially hollow country and needed about $700 billion every year in net inflows to survive. But within a month after “9.11,” the investment climate in the US had badly deteriorated to a level of worries and anxiety never felt before. No matter how strong it is, if the United States could not look after its own security, how could it ensure investors’ financial security? As a result, over $300 billion of hot money left the United States. This forced the United States to fight a war as soon as possible.

The war was not only to punish the Taliban and al-Qaeda, but also to regain global investors’ confidence. As the first cruise missiles exploded in Kabul. The Dow Jones rebounded 600 points in one day, the capital flowing out began to return to the US, and by the end, there was about $400 billion moving back to the US. Does this not prove that the war in Afghanistan was for the dollar and capital?

We suspect the dollar makes a after a new high—likely triggered by safe-haven buying, as money flows back into US capital markets (likely a new high in the US stock market). But as more and more catch on to the game, dollar hegemony will fade.

US global dominance is at this moment being clearly challenged; the US is no longer up to the task of defending its position.

From 2017, Andrei Martyanov, author of Disintegration: Indicators of the Coming American Collapse:

…in full accordance with Clausewitz’ dictum that “it is legitimate to judge an event by its outcome for it is the soundest criterion,” have accumulated today into a body of overwhelming empirical evidence of a serious and dangerous dysfunction within America’s decision-making process. From the debacle in Iraq, to the lost war in Afghanistan, to inspiring a slaughterhouse in Syria, to unleashing, with the help of its NATO Allies, a conflict in Libya, to finally fomenting a coup and a war in Ukraine—all of that is a disastrous record of geopolitical, diplomatic, military and intelligence incompetence, and speaks to the failure of American political, military, intelligence, and academic institutions.

And comments from General Latiff, Ph.D in physics and man with 20 years of service in DARPA, had this warning in 2017:

U.S. elites have simply stopped producing any truly competent people: the U.S. stopped producing real statemen, not just politicians, even earlier. When experts fail, as they failed America, not least due to many of them not being real experts at all, actors, comedians, sportsmen, conspiracy theorists and demagogues from the mass-media take their place…Now threatening this very “democratic society,” or whoever is left of it, is a powerful neocon and liberal interventionist establishment which has virtual veto power and is working hard. Both consciously and not, to end this very republican government.

In general, the current American elites and their so-called expert enablers have betrayed American vital interest both at home and especially abroad. What has specifically and greatly contributed to their miserable failure is an almost complete lack of understanding of the nature of military power, of war and its consequences. It couldn’t have been otherwise in the country whose military history is, to a very large degree, a triumphalist myth.

You don’t have to be a foreign policy elite to understand the smart move would have been to bring Russia into the You don’t have to be a foreign policy elite to understand the smart move would have been to bring Russia into the West, as a viable functioning member of Europe, instead of first trying to steal their resources, then treating them as a pariah.

This would have been a better way to stave off the real hegemonic challenge to the United States—China. But as General Latiff said so clearly—US elites have simply stopped producing any truly competent people, in positions of power, to recognize this.

So, this crowd of the US “best and brightest” is now leading its European Allies into a potential hot war against Russia. If it materializes, we suspect it will be yet another US sponsored debacle with Europeans left to pick up the pieces—a too common theme when the US foreign policy team springs into action to help and protect somebody.

The US needs to generate more arms sales and strengthen its vassal state control to feed its “foreign policy-Pentagon-Congressional-defense company-media company—Wall Street complex” now that the gravy train of Afghanistan is over.

So, as the US military adds to its estimated 350-military bases around the globe; China will add to its Belt and Road footprint. Russia will participate more deeply. China’s bond market will grow stronger and deeper and begin to take on a powerful safe-haven role. The Chinese currency will be more widely used in international transactions; as US dollar primacy fades along with its hegemon status.

China kicked off its yuan internationalisation plan in 2009, starting with trade settlements and eventually extending to yuan-denominated crude futures and investment in belt and road countries.

Meanwhile, China has improved a yuan-settlement channel known as the Cross-Border Interbank Payment System, has fast-tracked its cross-border digital yuan trials, and has set up a domestic joint venture with the SWIFT financial messaging service to strengthen global financial connections.

Overall, the overseas use of China’s currency is making progress, but it remains far behind the US dollar in terms of international payments, reserve currency and forex transactions.

The euro, however, is catching up, as SWIFT data showed that it accounted for 36.7 per cent of global payments in December, compared with 31.7 per cent two years earlier. The share of the US dollar fell to 40.5 per cent from 42.2 per cent in the same period.

Source: China Macro Economy, 26 January 2022

Given the arrogance, and complete lack of competence, displayed by the United States foreign policy team as it deals with Russia’s legitimate security concerns, effectively goading the Bear into attacking Ukraine, one can only believe it’s a matter of time before the US along with its remaining vassal states launches a hot war on China.

The Theodicies Trap has clearly been sprung.

The dying empire having lost all other vitality and economic productivity lashes out military in attempt to delay the inevitable decline. Stay tuned.

We hope this broad overview is helpful, or at least, interesting to you.

If you like what you see here, you can learn more about us, and subscribe to our service at our website. We also have live customer chat support to serve you.

Regards,

Gregor and Jack Crooks