Wall Street analysts see traders reduce hedging, ignore the Fed and the upcoming recession because of historic decline in stocks that affected both retail and institutional investors.

Wall Street analysts see that hedging is now difficult, because of the historic decline in stocks that have already wiped $13 trillion in market value this year and affected both retail and institutional investors.

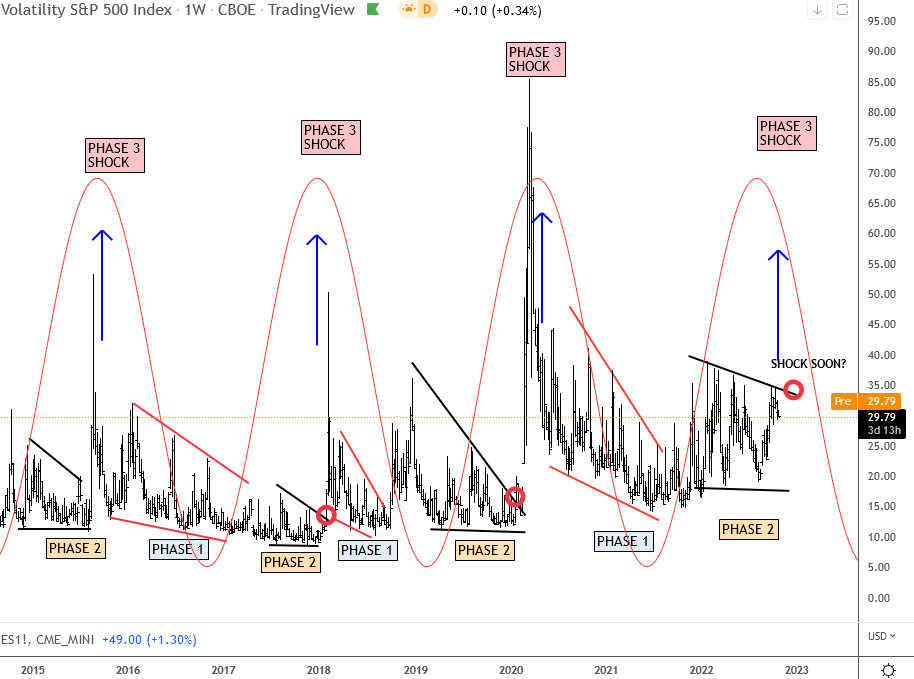

In the options market, the relative cost of contracts that pay off if the S&P 500 sinks another 10% has collapsed to its lowest level since 2017. And the mood for bullish bets is on the rise. Cboe’s popular volatility index (VIX) is well below multiyear highs, even as stock benchmarks sink to bear-market lows. All of this may sound strange given that the Federal Reserve remains determined to make aggressive rate hikes as the risk of a recession is now visible. But traders are tired of repeating the same bearish mantras.

As reported by Bloomberg, with cash on the sidelines, some investors are drawn to the idea that most of the bad news has passed and favorable seasonal patterns may yet come into play.

From an Elliott Wave perspective we are tracking two counts down on SP500, away from all time highs. First one below shows a zigzag with wave C now boucing from the supports, but we will need an impulse to 4200 to make sure that lows are in.

If rally is going to be in three waves, then this can still be only wave B of a complex W-X-Y. Somehow, we really love the second count, especially if we consider that “real shock” can still before low is formed. Lows on stocks are normally visible through sharp spikes. Keep in mind that on VIX there is still a chance for a phase #3; the “shock”.

by Grega Horvat and Stavros Chanidis

Interested in cryptocurrencies? Ethereum looks attractive again. Check our chart HERE