USDMXN Can Be A Good Short With Crude Oil On The Rise from technical point of view and from Elliott wave perspective.

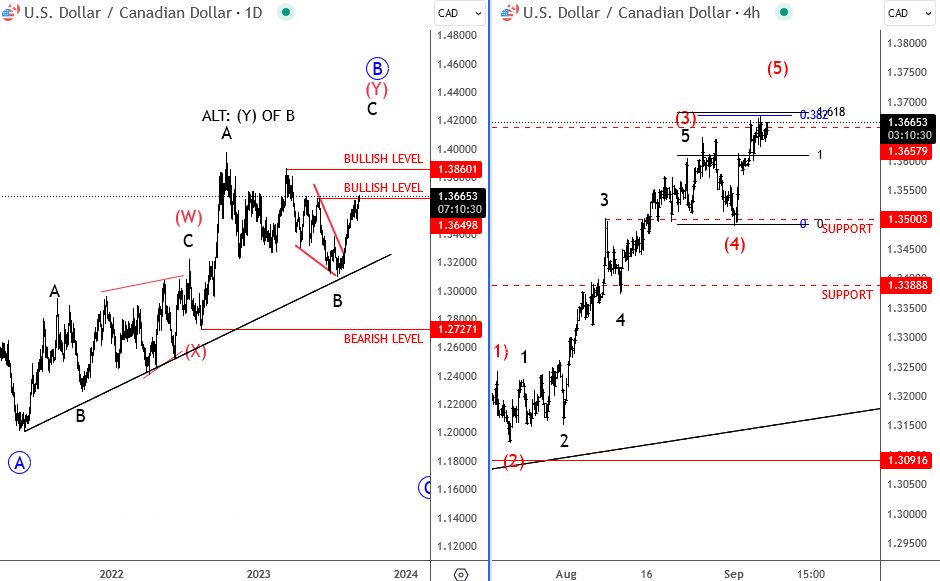

USDCAD has been in a bearish trend since the end of 2022. However, this trend began to shift when it found support along a trendline that can be traced back to the 2021 low. This price action suggests the possibility of a completed corrective drop, potentially forming an ending diagonal pattern. Traders should exercise caution as the current recovery appears impulsive when examined on intraday charts. Nevertheless, it’s worth noting that a five-wave upswing on 4-hour timeframes starting from 1.3090 could momentarily slow down the ongoing recovery, prompting a corrective move.

The potential correction in CAD gains further credibility when considering the robust performance of Crude oil. Crude oil prices have been exhibiting an impulsive pattern, with the potential to reach around 90.00. This upward movement in crude oil can have a positive influence on commodity currencies like the Canadian Dollar (CAD) and the Mexican Peso (MXN).

Furthermore, when examining the USD/MXN pair, it’s worth noting that it appears more favorable for bearish positions. The ongoing bearish impulse in USD/MXN, followed by the current rally in wave four, has brought the pair to an interesting resistance area. This presents a compelling opportunity for traders looking to take advantage of potential downside movements in the US Dollar relative to the Mexican Peso.

In summary, the interplay between Crude oil prices and currency pairs like USDCAD and USDMXN is intricate. Crude oil’s performance can significantly influence the strength of commodity currencies such as CAD and MXN. Therefore, traders should not only analyze the technical aspects of these currency pairs but also remain vigilant about developments in the energy markets to make informed trading decisions.

Trade well,

Grega

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

USDOLLAR At Resistance Zone Ahead Of US Inflation Report. Check our free chart HERE.