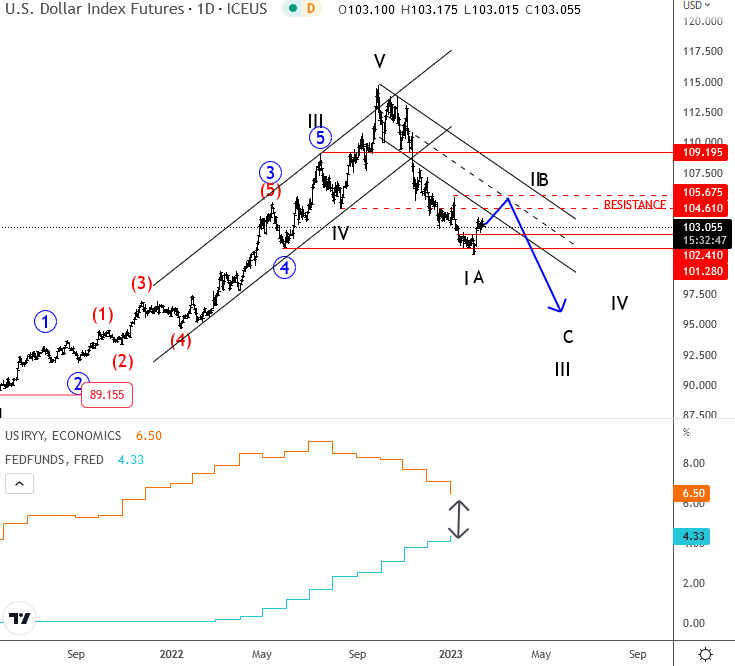

USD in recovery mode ahead of US CPI, as we see it unfolding a three-wave correction by Elliott Wave theory.

Welcome to a very important US CPI day, which is widely expected as numbers can give us more clarity about what’s the FED going to do next. Will they look for more hikes, even to 50bp if data disappoints, or will inflation come even lower, and they are done with hikes soon? No one knows the answer at this point, but what we know is that the corrective rally on USD is incomplete and that we are waiting on A-B-C formation from the low before we start looking down again.

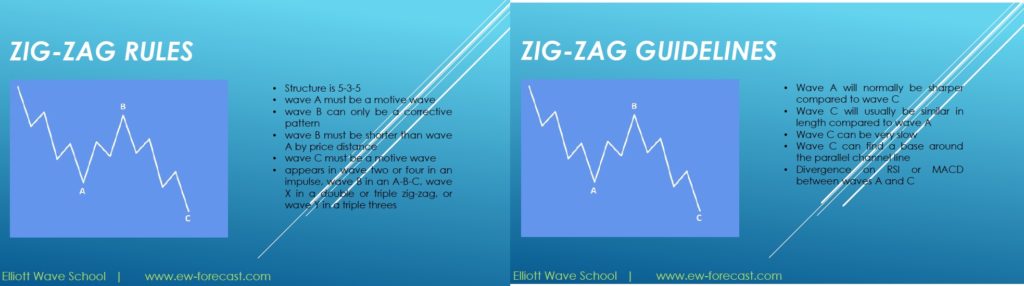

Looking at the USD Equal-Weighted 4H chart, we see sharp reversal and strong recovery from the lows after completion of 5th wave. So, ideally that was wave A as part of a possible zig-zag correction that can be followed now with pullback in wave B and then another jump for wave C. Once a corrective pattern fully unfolds, we will look for a new continuation down.

USD Index is trading down since October 2022 where we think that the dollar might have seen an important, multi-year top. Notice that the decline on a daily chart is strong and impulsive, meaning that there can be more weakness coming, but after a pullback. It doesn’t matter what the outcome of today’s US CPI report will be, keep in mind that USD is bearish, we are just looking for a temporary pause within downtrend.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Interested in detailed view including more analysis? Check our live webinar recording below:

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Decade And Multi-year Cycle On EURODOLLAR. Check free chart HERE