The Fed’s ‘soft landing’, the Threat of a Deep Recession and FedEx’s distress signal. Technical analysis from Elliott wave perspective.

According to the last week’s economic data inflation continues to surprise upside whereas the economy continues to surprise downside. Nevertheless, the recession hasn’t come yet, but the 2 last adjacent quarters showed deceleration of the development, and a cut in the ensuing quarter estimated at 0.5%, as the Atlanta Fed stated last week.

Moreover, markets continue to make a big mistake believing that the FED’s strict policy in both ways respecting the hike in interest rates for four consecutive months. Tightening with a double rate of change its balance sheet at $95 billion per month could ‘’soft landing’’ the economy in the United States and drop the inflation at 2%. And why is that?

Because the entire economy was based on artificially low-interest rates for over a decade. The supply of money to the system was exceeding all-time highs increasing the U.S debt to unmanageable levels. The housing market is collapsing already and due to higher prices in almost all products, we had the FedEx’s announcement for office closings and layoffs concerning the falling demand for transportation needs.

Most people agree that the US economy will go into recession. But according to the FED’s officials and the real willingness of Jerome Powel to fight against the monster of inflation, everyone believes that even if we would have a recession, it should be short and shallow.

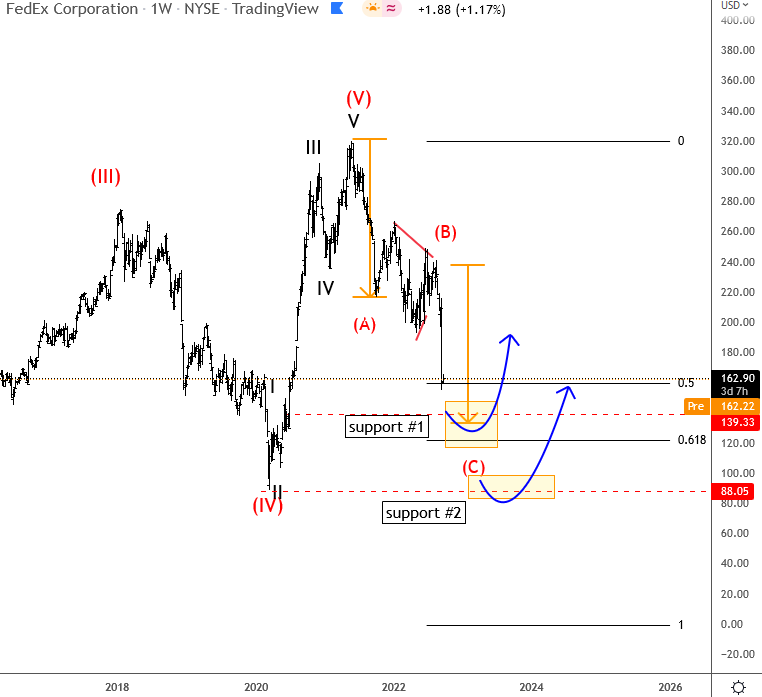

Reminding FedEx, just to illustrate from the Elliot Wave perspective our view for the stock, since it has lost almost 50% of its value. Its peak was at $319.90 and now is traded at $162.90.

Looking at the weekly chart we see ongoing correction, currently with three waves down with wave C targeting $140, followed by $90.00 supports. We think that down there FedEx can have an attractive support for a longer-term investment, especially if FED will slow down the hawkish look, or possibly even turn dovish if recession will take place on a global scale.

By Grega Horvat and Stavros Chanidis

Aussie remains bearish after RBA policy meeting. Check our AUDUSD chart HERE