Stock market decline may cause bond market recovery, as we have a negative correlation between the assets.

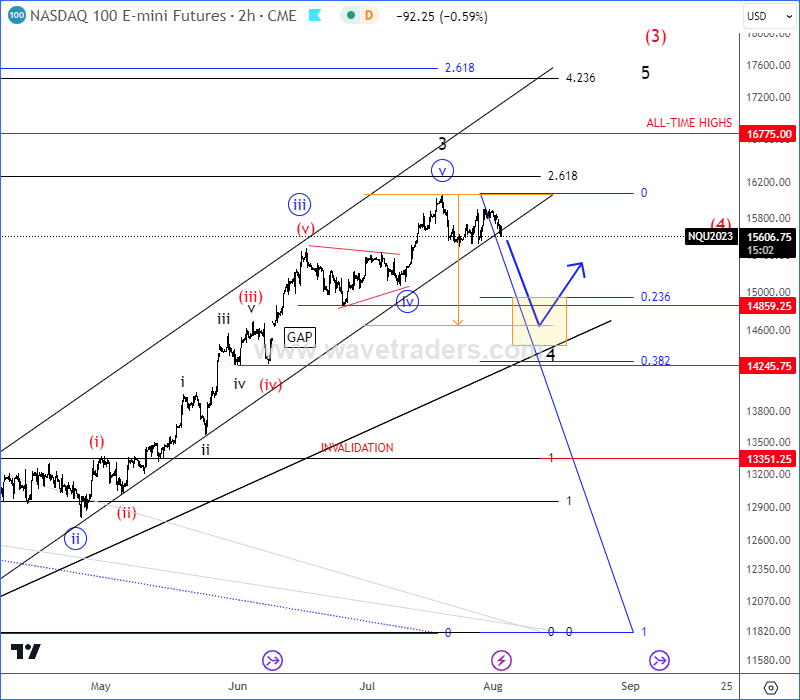

Stocks are slowing down and we see NASDAQ100 trading in a higher degree (A)-(B)-(C) corrective decline that can the price back to 14800 – 14200 support area before the uptrend for wave 5 of (3) resumes.

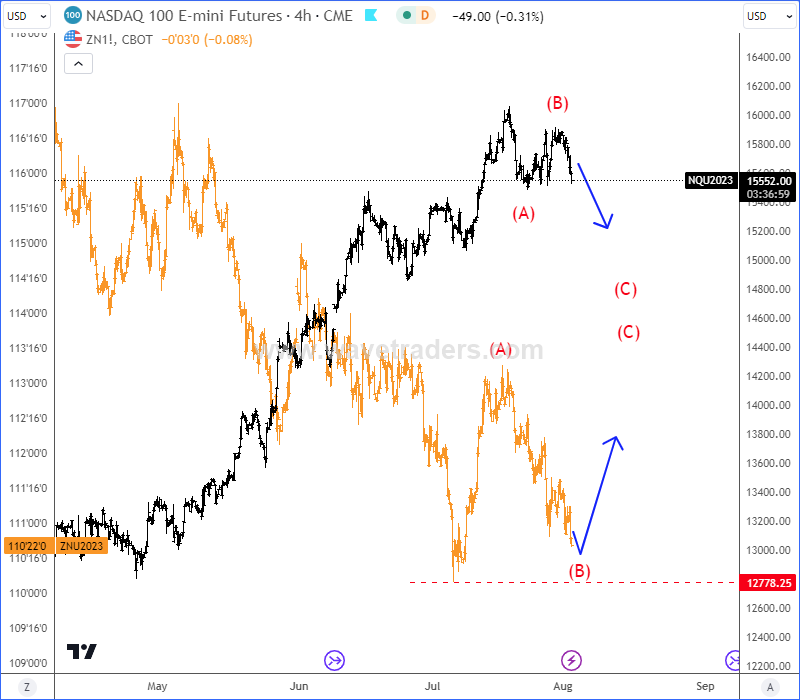

The main reason for a stock market slow down are treasury bonds. 10Y US Notes is right now sitting at potential support area for wave (B) that can cause bigger recovery for wave (C), which can easily push stocks into lower supports.

As you can see in an overlay chart, there’s a clear negative correlation between NASDAQ100 and 10Y US NOTES, where wave (C) of an (A)-(B)-(C) reversal can be now underway.

Become a premium member

Get daily Elliott Wave updates for some major Digital currencies, FIAT currency markets, major stock indexes, gold, silver, crude etc. or apply for unlimited access to the Elliot Wave educational videos.

Aussie Can Be Finishing A Flat Correction Within Uptrend. Check our free chart HERE.