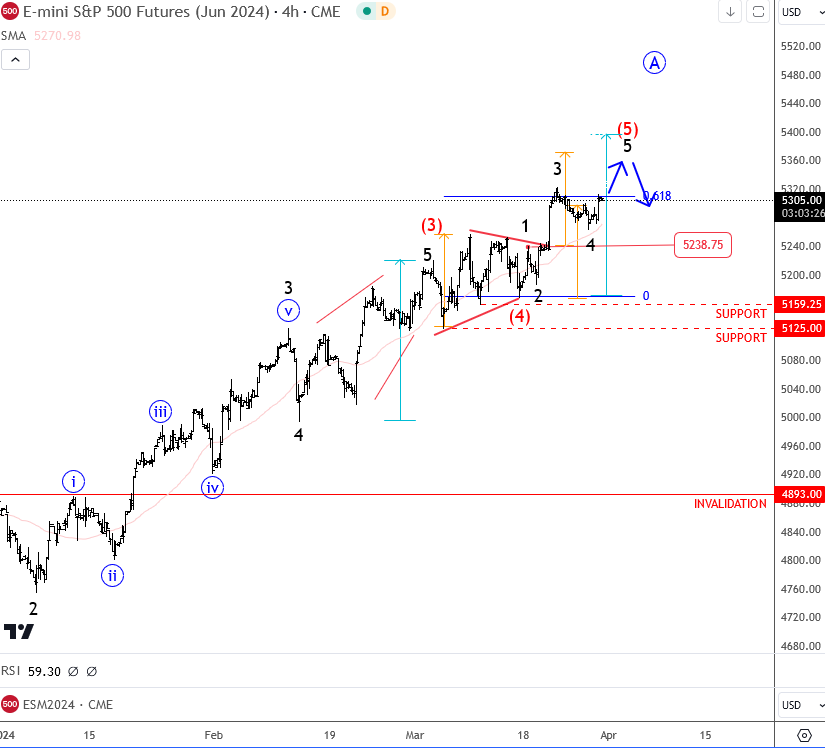

SP500 made a textbook breakout from an Elliott Wave triangle pattern, after we saw it consolidating within a strong bullish trend

SP500 is in strong higher degree bullish trend which may not be over just yet on the big picture, but sometimes it’s good to scale down to smaller time frames, and recognize the wave pattern that can give you an interesting opportunity in the direction of a main trend. Well, we been tracking these intraday developments quite closely on the SP500, thus we want to highlight how we done it.

On March 19 we have noticed a sideways consolidation, which usually represents a wave (4) pause, in our case that was an Elliott wave triangle corrective pattern which was important one for a new break higher into a wave (5). We specifically highlighted important Fib projection levels near 5320-5400.

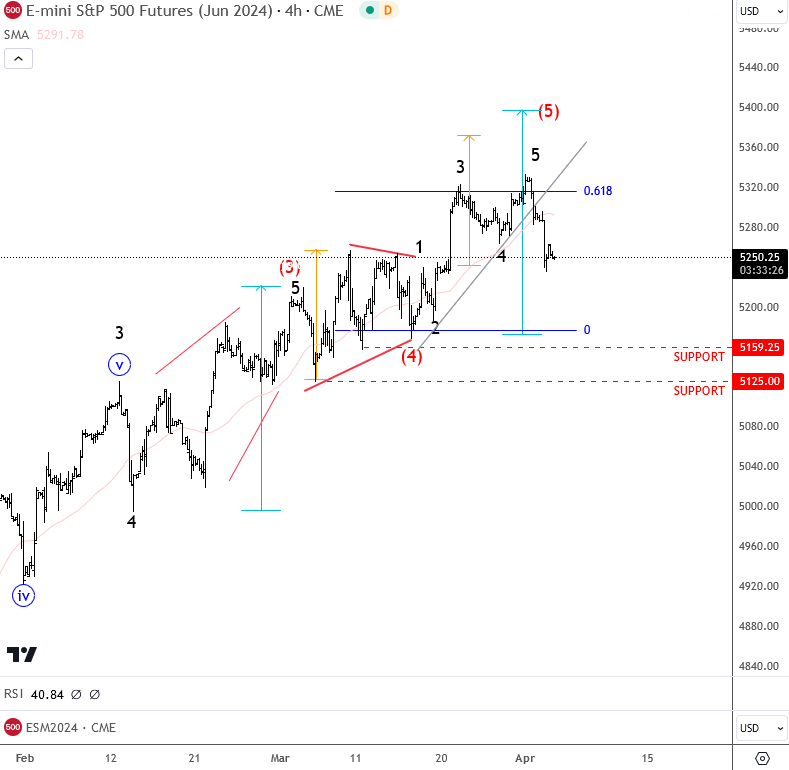

Later, on March 28th, we have seen a nice bullish breakout from a projected wave (4) triangle pattern as expected. So, we were tracking wave (5), but a lower degree five-wave cycle was unfinished and that’s why we expected another and final push to the upside for the final five of five.

Whats even more important is that whenever you have a move out of a triangle, this can then be a final one sequence. So we warned about limited gains and a reversal

As you can see as today, April 3rd, SP500 is turning sharply down after a completed five wave sequnce. It looks like bulls are on the pause, but what’s next? Correction, or a top?

Join us in our premium services and track SP500 daily.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Crypto Market Is Still In A Higher Degree Correction. Check our free chart HERE.