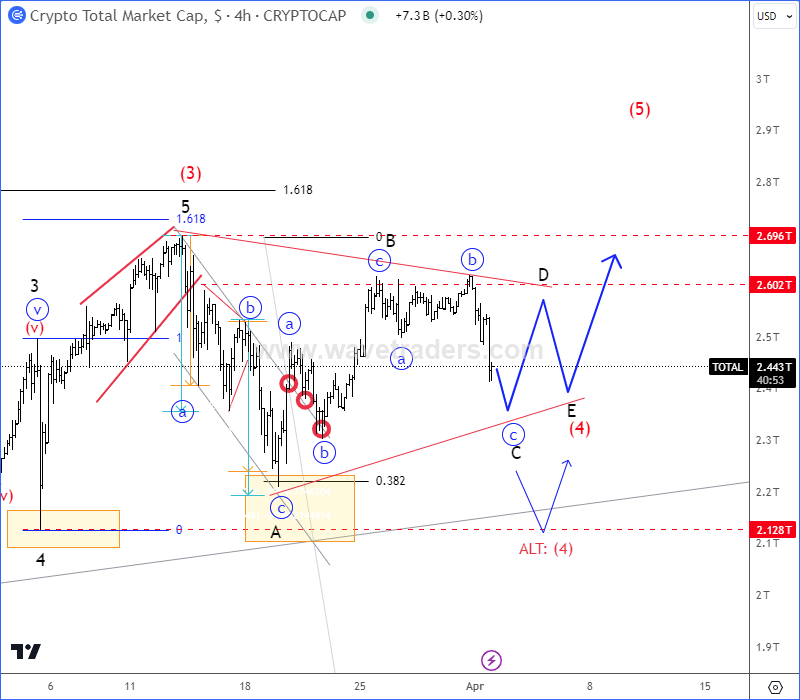

Crypto market is slowing down after the Easter holidays, as we are getting some risk-off flows, while USDollar keeps recovering, but we still think it’s a higher degree wave (4) correction, it’s just turning out to be more complex. As a primary view we are tracking a bullish A-B-C-D-E triangle pattern, where subwave »c« of C can be now in progress and it may find the support already around 2.3T area. However, secondary count may also lead into a larger flat correction within wave (4), where subwave C could be unfolded as an impulse and it can retest 2.1T – 2.0T support zone before bulls for wave (5) show up again.

If you believe that #bitcoin will resume higher after halving, and you want to take advantage of the current consolidation, then these are levels to watch. CLICK HERE

Become a premium member

Get daily Elliott Wave updates for SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Elliott Wave Live: Dollar’s Rise Following ISM Manufacturing PMI Data. Check our blog HERE.