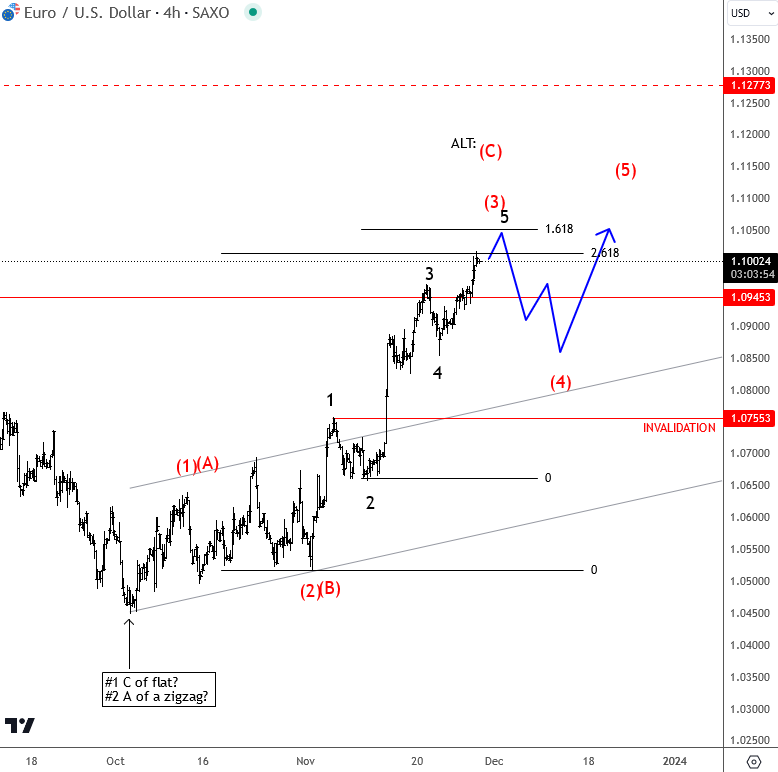

EURUSD Is Trading In An Impulsive Recovery from technical point of view and by Elliott wave theory.

Euro is trading higher, it’s recovering with sharp reaction higher since US CPI came lower than expected for October. We see price making extension within wave (3) of a new bullish sequence, which is our primary look because of a broken base channel. So euro can strengthen further, but be aware of some intraday 4th wave pullback from the current Fib resistance here at 1.1050 – 1.1100 area. Also, if the price stays in an uptrend with the current sharp rise, then a higher degree correction from the 2023 highs can be finished. A break below 1.070 will be again bearish for the euro.

For a detailed view and more analysis like this, you may want to watch our latest recording of a live webinar from November 27 below:

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Ethereum Is Eyeing April Highs After A Pullback. Check our blog HERE.