Hello Crypto traders, today we will talk about Ethereum, its price action from technical point of view and wave structure from Elliott wave perspective.

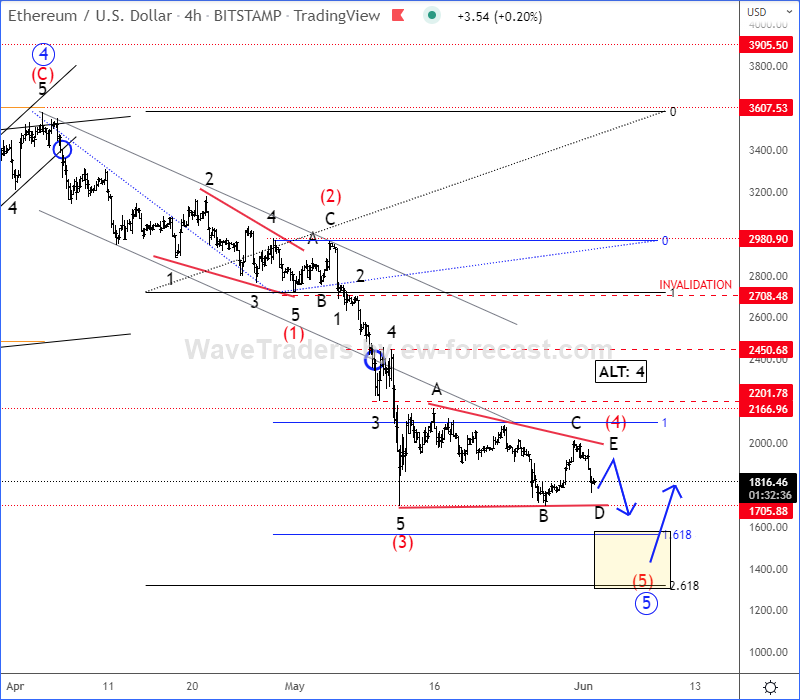

Ethereum is still bearish, but we can see it finishing an Elliott wave five-wave cycle within 5th wave of a higher degree wave C. It means that support/bottom may not be far away, ideally after that final leg down.

As we actually expected, ETHUSD remains under strong bearish pressure in the 4-hour chart and seems like a five-wave bearish cycle within 5th wave is still in play. So, once current Elliott wave corrective triangle consolidation in wave (4) fully unfolds, be aware of a bearish continuation for the final wave 5. It can be actually slowly coming to an end, as final subwave E is missing. So, it can later easily send the price even down to 1500-1300 area before real bulls show up.

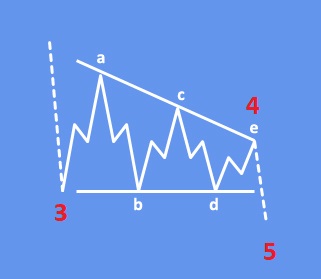

Triangle is an Elliott wave pattern seen during sideways market consolidations. It is composed of 5 corrective sequences. Triangle presents a balance of forces between buyers and sellers. It causing a sideways movement that is usually associated with decreasing volume and volatility. This pattern subdivide into 3-3-3-3-3 structures labeled as A,B,C,D,E. It is a continuation pattern which breaks in direction of the preceding move.

Happy trading!

Want to see our view in the markets globally? Check our latest video update HERE