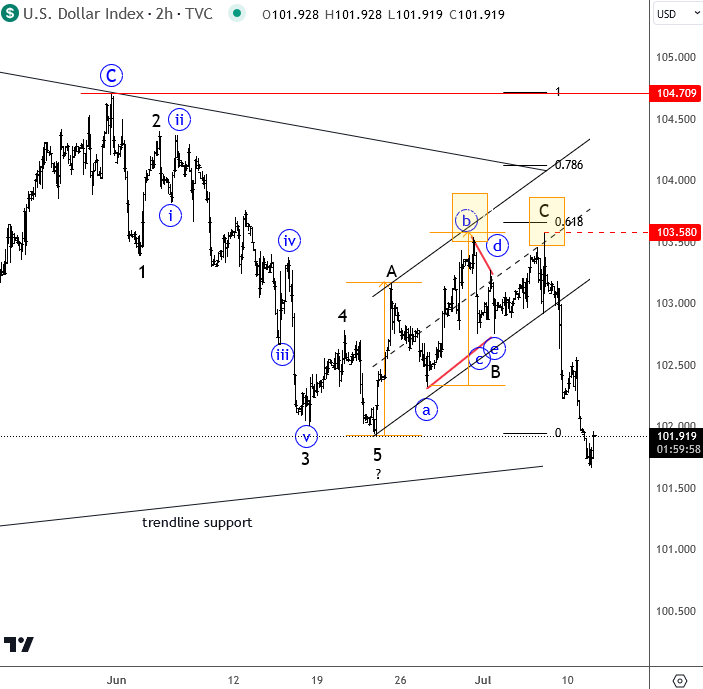

USD Index – DXY is turning down after A-B-C corrective rise that faced limited upside about we were warning in our past Free publication HERE where we specifically noted and highlighted 103.50 as a resistance area. Notice that high of that correction was 103.58, before prices came down to a new low of July.

The catalyst of-course was the NFP miss on Friday, and speculation that FED has only one or two hikes left before they complete the hawkish policy. But despite the jobs figures, the trend and price action were clearly showing us a bearish pattern before the release, so it’s even more interesting for dollar bears when you have both; news and Elliott wave cylces that show the same thing.

The question is where we go from here?

Well, keep in mind that we are in the middle of summer, so trading conditions can be thin meaning that big ranges may not be broken that easily. Also, we have the US CPI coming out tomorrow, so certainly, there can be some more interesting dollar moves. However, there can be some dollar rallies before the market may resume even lower.

If you want to be on track with our Elliott wave view, then check our premium services and get access to different FX pairs, GOLD, SILVER, DAX, SP500, 10 YEAR US NOTES, CRUDE OIL, and even Cryptos.

Grega

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.