DAX is coming higher after a consolidation, which can be final leg before a slow down by Elliott wave theory.

DAX has been trading higher since October 2022, but five waves up from that low suggest that bulls can slow down into a higher degree correction, ideally down from 16200 – 16500 area where subwave five seen on 4h chart can come to an end, about we talked in past updates.

On May 16th, we have spotted a completion of a complex W-X-Y corrective consolidation within wave (4) in the 4-hour chart.

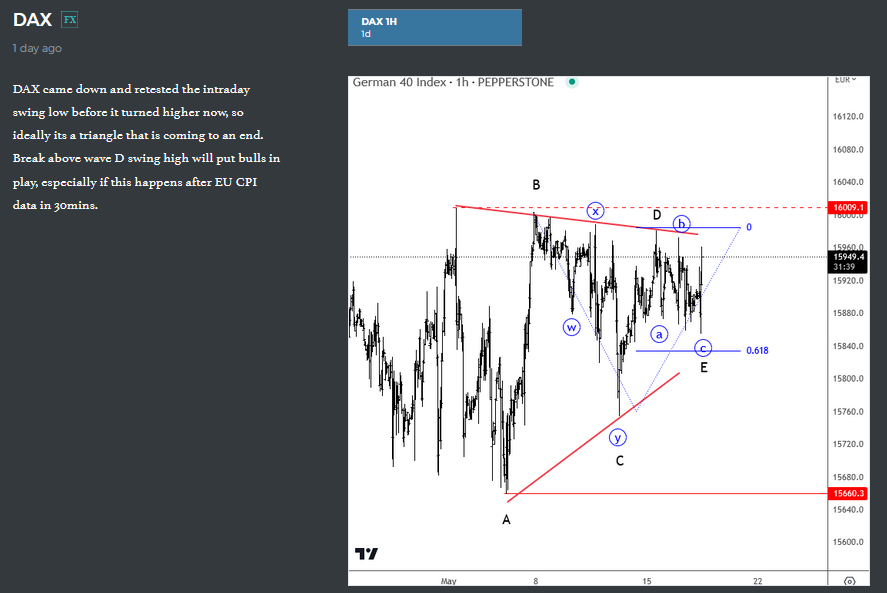

Even in the hourly chart we were nicely tracking an A-B-C-D-E triangle within that final wave Y.

So far we can see a sharp move out of a fourth wave consolidation, out of a triangle as well, so we assume that this can be final leg before turn.

On the intraday basis we can see a very sharp and impulsive move with price possibly targeting the 16200; triangle measurement move. But keep in mind that triangles occur prior to the final leg within a higher degree trend, so this can be now late stages of a recovery on DAX. If we are correct then DAX can face limited upside next week.

Become a premium member

Get daily Elliott Wave updates for SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Check our new video analysis sponsored by Orbex HERE.