Bullish turn on Crude oil out of ending diagonal (wedge) pattern can be strong resistance for USDCAD currency pair.

Hello traders, today we will talk about relationship between Crude oil and USDCAD pair from technical point of view and Elliott wave perspective. As we already know, they are in negative correlation as Canada has one of the largest oil reserves.

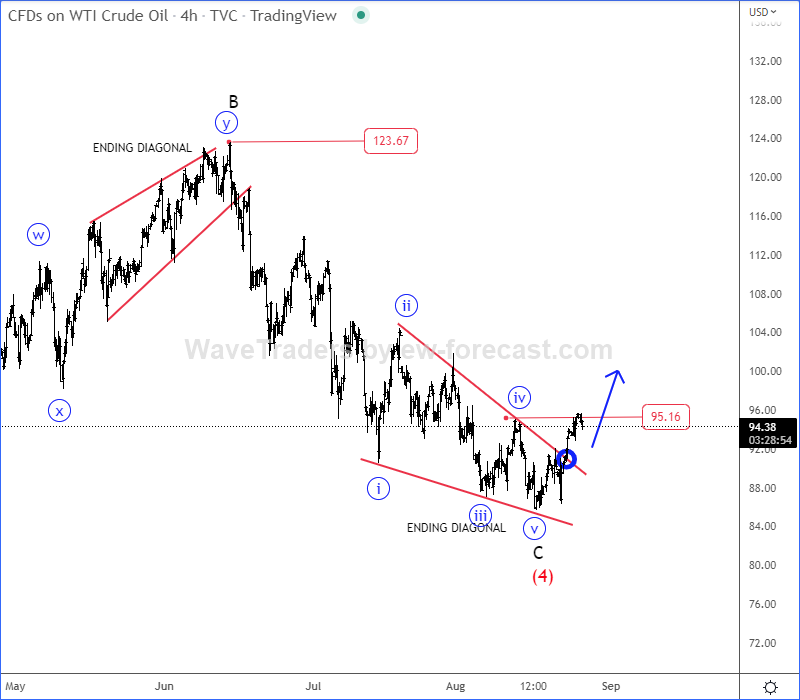

If we take a look on Crude oil chart, we can clearly see a completed ending diagonal (wedge) pattern within wave C of an A-B-C correction from the highs and with recent break back above 95 level, seems like correction is completed and we can easily expect more gains.

Well, if Crude oil is really turning bullish, then USDCAD currency pair could be upside limited if we respect negative correlation. Looking at the chart, we can see it finishing ending diagonal (wedge) pattern within wave (C) of an A-B-C correction in wave B that can cause a reversal down back to lows for wave C.

If we are on the right path, then Crude oil will stay up in upcoming days/weeks, while USDCAD can be looking for a bearish continuation.

Trade well!

USD can be nearing target zone against treasury bonds. Check also our latest DXY/ZN ratio chart HERE