Bank of America worries about global meltdown from the bond market as it’s declining within deeper correction from Elliott wave perspective.

As reported by MarketWatch, according to the Bank of America, there are worries about the bond market of $24 trillion will bring a new crisis in the economy as well as in assets since the FED’s tightening policy is going to be accelerated. As many financial analysts at Bank of America support, the ‘’biggest’’ bear market of all time has come and is already there. And the reason is that the bond market considers the most liquid of all asset classes. So, with the overall opinion that prices haven’t discounted the consequences of inflation yet, despite the ongoing sell-off in the stocks the worst-case scenario would be for the market to dry up.

The investment sentiment is the worst since the ‘’Great Recession’’ in 2008, and the US bond yields are at a historic high. The US unemployment rate is expected to be between 4%-5% in the next quarters.

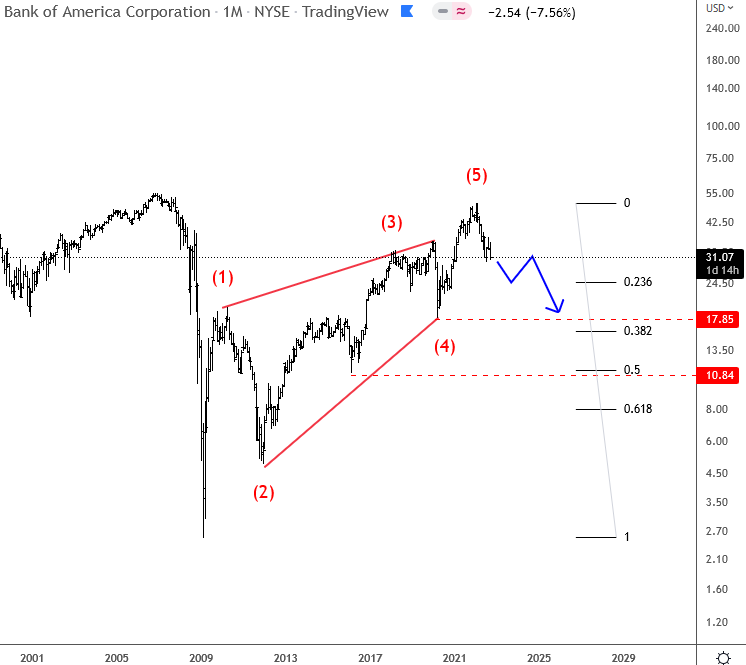

From the Elliot Wave perspective, let’s take a look at the weekly chart of Bank of America.

The historical highs were achieved in 2006 at $55.08 just before the subprime crisis began, and against $2.58 in March 2009 the stock moved significantly higher with a motive wave structure but not able to reach the previous high. We think that stock made a leading diagonal, and that price is now headed for a deeper pullback. First support is at $17.85, followed by $10.80.

by Grega Horvat and Stavros Chanidis

Interested in FX market? Check our latest USDCAD free chart HERE