AUDNZD bears are back, as we see it turning sharply down after a completed corrective rally by Elliott wave theory.

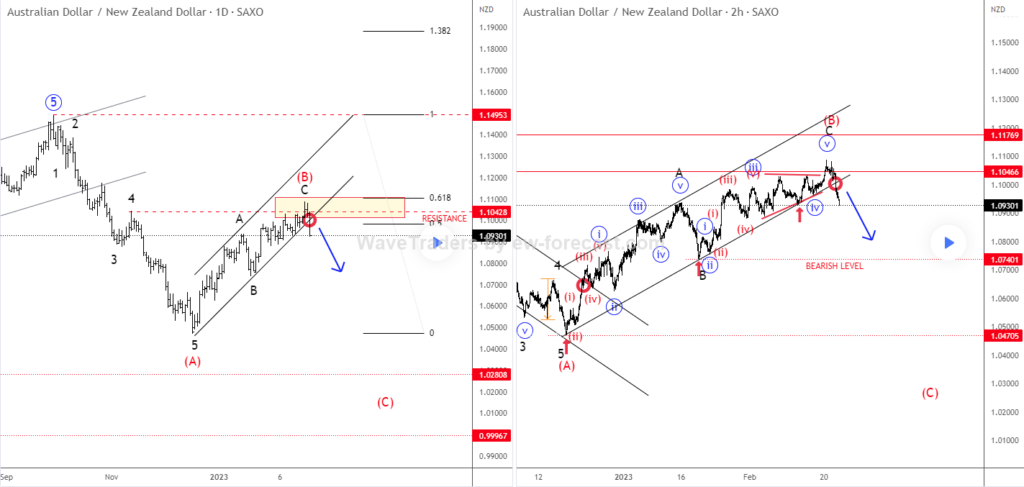

AUDNZD turned sharply down in the last quarter of 2022, away from the upper trendline of a previously bullish EW channel which is usually the ending point of a higher-degree structure on a daily chart. We talked about this in our 2022 updates and warned about a bearish turning point which is now in full progress and will most likely resume much lower as pair shows an impulsive drop for wave A.

However, nothing moves in a straight line, so wave (B) corrective rally is not a surprise either. It made a nice three-wave A-B-C correction in wave (B) perfectly into projected golden 61,8% Fibonacci retracement at the former wave 4 resistance area in the 1.10 – 1.11 area.

Well, as you can see AUDNZD pair is now dropping sharply from projected resistance and it’s also breaking important channel support line in the 4-hour chart. So, seems like higher degree wave (C) is now in play that can send the price down to 1.03 area or lower, especially if breaks beneath 1.0740 bearish confirmation level.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

USDSEK: Elliott Wave Triangle Is Pointing Down. Check our chart HERE