Hello traders, today we will talk about AUDJPY currency pair, its price action from technical point of view and wave structure from Elliott wave perspective.

AUDJPY is in an impulsive rally, which looks to be unfinished. In Elliott wave theory, every impulse should be completed by a five-wave cycle.

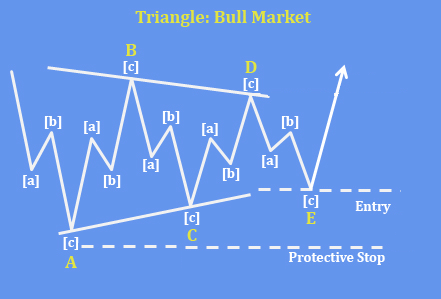

Well, after a three-wave A-B-C corrective decline back in May, we believe that AUDJPY is unfolding a new five-wave bullish impulse in the 4-hour chart. Currently we can see it slowing down within wave 4 correction, which more and more looks like a bullish triangle formation. So, once the pattern fully unfolds, be aware of a bullish resumption for the final 5th wave. And, it can ideally stop around projected 261,8% Fibonnaci extension and 98-100 area. Wave 4 should not retrace into territory of wave 1, so invalidation level is at 91.10.

If you want to trade this pair, then you may wait for a triangle to be fully completed. At the moment we are tracking subwave »c«, so subwaves »d« and »e« still yet to come. Once wave »e« is finished and the price starts breaking back above wave »d«, then this is the best entry with protective stop below subwave »e«.

Happy trading!

Stocks look attractive again. You may want to check our latest DAX and NIKKEI charts. CLICK HERE