Good morning all. US stock market is coming down since start of April, which can be firstly due to quarterly portfolio adjustments and also due the hawkish FOMC projections. The US yields continue to rise which is making USD very strong across the board; even commodity currencies are coming lower for the last few trading days. However, its busy week with some of central banks policy decisions, which can have some important shifts on currencies.

However, today I want to look at gold. Which is coming higher as investors want to protect themselves from higher inflation. But key for metals direction in the future can be how much FED will hike in upcoming months. They certainly will try ot fight inflation, and if successful gold may stop at resistance.

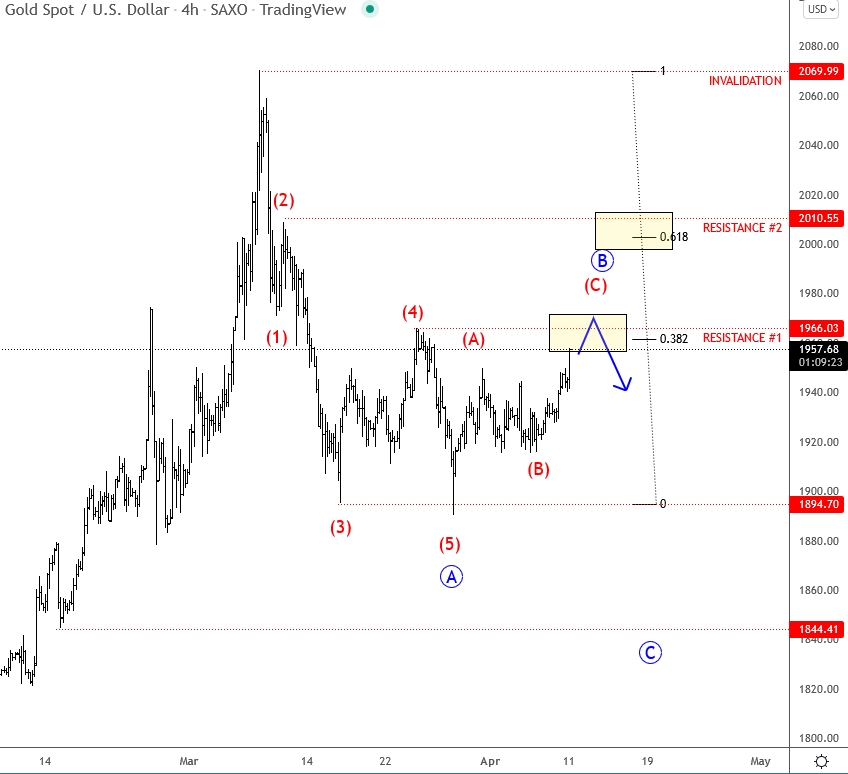

From an Elliott wave theory perspective we see gold in a bearish reversal mode after that five waves down from $2070 area. It’s a bearish impulse that signals for a higher degree of an Elliott wave corrective pullback. Elliott wave correction is made by minimum A-B-C legs. So it appears that current leg up is wave B still, so upside can be limited. We see nice resistance at 1966 followed by a second and much mor important level around 2k. Much more important and strong support for a next bounce on metals can be from around 1844 area on gold, but if 2070 is broken before that, then I will immediately turn bullish for much higher prices.

Trade well.